Fund Prospectus

The fund's prospectus is the most important document and the one that you need to spend the most of your time and attention. It is a good idea to hire a local law firm to help draft the prospectus as they will be familiar with the topic you need to cover and the optional topics - references are at the bottom of the document.

A prospectus is a formal legal document that provides detailed information about an investment opportunity, such as a securities offering or a mutual fund. It is typically prepared by the issuer or the fund manager and is used to provide potential investors with essential information to make informed investment decisions.

In the context of a Digital Assets investment fund, a prospectus serves several important purposes:

- Disclosure of Information: A prospectus discloses comprehensive information about the crypto investment fund, including its investment strategy, objectives, risks involved, fees and expenses, historical performance, and the legal and regulatory framework within which the fund operates. This information helps potential investors understand the nature of the investment, evaluate its suitability for their financial goals, and assess the risks associated with it.

- Transparency and Investor Protection: By providing detailed and accurate information, a prospectus promotes transparency and investor protection. It ensures that investors have access to essential facts about the fund, enabling them to make informed decisions based on complete and reliable information.

- Compliance with Regulatory Requirements: In many jurisdictions, the offering of investment funds, including crypto funds, is subject to regulatory oversight. Issuing a prospectus is often a legal requirement to comply with securities regulations. The prospectus must adhere to specific guidelines and standards set by regulatory authorities to protect investors' interests and maintain market integrity.

- Marketing and Investor Confidence: A well-prepared prospectus can serve as a marketing tool to attract potential investors. It provides credibility to the investment fund by demonstrating a commitment to transparency and professionalism. A prospectus also helps build investor confidence by ensuring that the fund is managed in a responsible and regulated manner.

It's important to note that the specific requirements for a prospectus can vary by jurisdiction and the type of offering. Regulations regarding investments in Digital Assets and funds are still evolving in many countries, and there may be specific rules and guidelines for Digital Asset investment fund prospectuses that differ from traditional investment funds.

For a fund incorporated in Gibraltar, the relevant guiding document for what should be included in the Prospectus is: Corporate Governance Code for Crypto Funds - GFIA

The sections in this document are the standard sections of a prospectus with a description of what it is for and a sample language.

Table of Content

Introduction

This document (hereinafter “Prospectus” or “PPM”) for the establishment of a Private Fund established under the laws and regulations of Gibraltar.

<<Insert Company Name>> (the “Company” and/or “Fund”) to be used interchangeably, is a Private Company Limited by Shares incorporated and registered under the Companies Act 2014 in Gibraltar. The Company was incorporated on the <<insert incorporation date>> and has incorporation number <<insert incorporation number>>, its registered office is situated at <<Insert Office Address>>. The Companies shareholders are <<INsert List of Company Shareholders>>and the Companies Directors are <<Insert List of Company Directors>>

The Fund will be considered a Private Scheme under Gibraltar law, meaning it will fall under the meaning of section 293(4)(b) of the Financial Services Act 2019. Private Fund and Private Scheme may be used interchangeably throughout this PPM.

Under the abovementioned section, the Private Fund will only qualify as such and will not trigger specific licencing or regulatory requirements nor will there be any specific investor qualifications imposed, so long as the Participating shares are only offered to the following (known as the identifiable individuals):

- the offer is addressed to an identifiable category of persons to whom it is directly communicated by the offeror or the offerors appointed agent;

- the members of that category are the only persons who may accept the offer and they are in possession of sufficient information to be able to make a reasonable evaluation of the offer;

- number of persons, in Gibraltar or elsewhere, to whom the offer is communicated does not exceed 50; and

- the offer is made in respect of units in a scheme that is, or on its establishment will be, a private scheme and that will remain as a private scheme for at least one year after the date that the offer is made.

The fund aims to provide investors with exposure to the Cryptocurrency market through a diversified portfolio which will be further particularised within this Prospectus.

Members should be aware of the ability under the Financial Services Act for the Private Fund to turn into an experienced investor fund (“EIF” or “Collective Investor Scheme”) after one year of being a Private Scheme. EIF’s are more suitable for professional, high net worth or experienced investors. EIF’s must be registered with the Gibraltar Financial Services Commission (“GFSC”), being the regulators of financial services in Gibraltar.

The composition of an EIF includes but may not be limited to the following:

- at least two directors which must be licenced as EIF directors;

- a depositary who acts as a custodian of the Private Funds’ investments and has regulatory duties such as ensuring that cash flows are properly managed (unless it is a closed ended fund) of the GFSC state otherwise; and

- an administrator who must be domiciled and regulated in Gibraltar

Management of the Fund

The Directors of the Fund are <<Insert Director's Name 1>> and <<Insert Director's Name 2>>. The Directors oversee and manage the investment activities of the Fund. The Director will assume the functions of acquisition, management and disposal of the Fund’s investments in pursuit of the investment objective as outlined herein.

<<

Insert Brief Experience of Director 1 and 2 focusing on:

- How they will contribute to the management of the Fund,

- Where they complement each other and

- Their professional experience

>>

Any proposed changes to the Management of the Private Fund or composition of the Board of Directors will be announced to investors at least seven (7) Business Days before such changes come into effect.

The Director may call on the services of other persons and/or advisers to make recommendations in relation to the particular markets in which they specialise and to advise upon how the Fund should invest; however, the Director shall at all times remain responsible for overseeing and managing the investment activities of the Fund.

The Director will have the sole, absolute discretion and overall responsibility to make the decision as to which investments should be acquired by the Fund and when they should be acquired provided such investments comply with Investment Objective and Asset Allocations of this PPM. Such responsibility includes the discretion to allocate the assets of the Fund to, or withdraw from, any investment of the Fund while observing the investment objective, investment strategy, risk management and restrictions that are contained within this Private Placement Memorandum.

Investment Objectives

The Fund's investment objective is to achieve above-average capital growth and positive returns by investing in Digital Assets while always remaining fully transparent with investors on what investment strategies are to be taken and how funds are to be managed.

The Private Fund seeks to make investments in Digital Assets market more accessible and assist investors who will not be required to pick specific cryptocurrencies or manage a portfolio themselves, which would naturally involve constant monitoring of developments within the industry.

The Fund shall utilise and deploy proprietary trading models and algorithms in pursuit of its investment objective. The Board of Directors may utilise third-party algorithms in pursuit of the Investment Objective. It should be noted that the Fund shall not be limited in the number of algorithms that it chooses to deploy.

The algorithms that the Fund has identified to date have been developed to include many unique and innovative features, taking ideas from many branches of science and engineering. <<Describe specific algorithms that the Fund will use>>

The Fund will seek to employ a disciplined research process to identify potential investments. <<Described the reach process to identify investment opportunities>>

The Fund’s risk management framework will seek to constantly monitor various types of risks with a view to preserving capital of primary importance.

The Digital Assets the Fund trades are typically liquid; however, they are still subject to the volatility inherent in the Digital Asset market.

The Fund may deploy hedging and short-selling strategies at the Investment Director’s sole and absolute discretion. This may include derivatives such as options and futures.

There can be no assurance that the Fund will be able to achieve its investment objective or that investors will receive any return on their capital. Investment results may vary substantially on a daily, monthly, quarterly or annual basis based in part to the volatility of cryptocurrency markets.

Investor Warning

The Board of Directors will at all times put the best interests of the fund at the forefront of their priorities; however, investments in private funds dealing with Digital Assets bear risks which must be taken into account by all investors. Such risks are detailed within this PPM and despite the objective being capital appreciation, no assurance can be made that this will be successful.

Asset Allocation

The percentages of capital allocated to each Core Strategy are subject to the following permissible variables:

- 10% per quarter in each Core Strategy e.g. Stablecoins between 10% and 30%; and

- By more than 10% as long as it is communicated at least 1 full quarter in advance to the investor through the quarterly newsletter

The Board of Directors can introduce New Core Strategies as long as they are sufficiently distinct from all the other ones and are communicated to investors in advance. The differentiating factor will be the correlation in the expected payment profile of the strategy. The decision to introduce a new Core strategy and the % asset allocation will be communicated 1 quarter in advance of its introduction in the Fund’s quarterly Newsletter. For example a new Core Strategy to be introduced in Q3 needs to be communicated to the investors before the end of Q1 to allow the investors 1 quarter to assess its impact on their risk appetite.

Although the Board of Directors will take all reasonable care to ensure that the aforementioned allocations are kept throughout the life-cycle of the Fund, the Board will have ultimate discretion and decision on how such assets are allocated and will have the best interests of the fund in all decisions made.

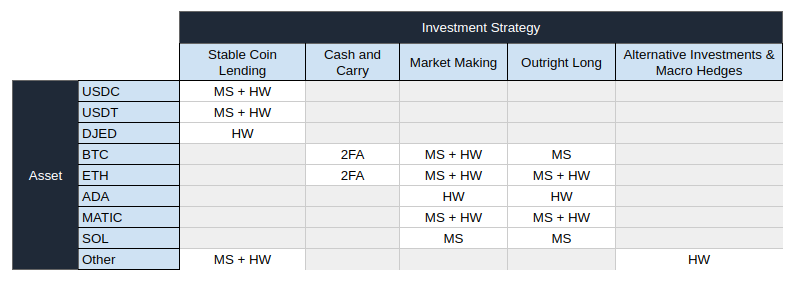

The initial Asset allocation is to be diversified across five (5) core strategies (the “Core Strategies”). These will include the following:

Stable Coins

Stablecoins are a type of a Digital Asset designed to have a relatively stable value, usually pegged to a specific asset or a basket of assets. Unlike many other cryptocurrencies like Bitcoin or Ethereum, which can be highly volatile in terms of their value, stablecoins aim to provide a more stable and predictable value, making them suitable for various financial transactions and applications.

There are 3 main categories of stablecoins in which the Fund will invest:

- Fiat-Collateralized Stablecoins: These stablecoins are backed by traditional assets like fiat currencies (e.g., US Dollar, Euro) held in reserves. For every stablecoin issued, a corresponding amount of fiat currency is held in a bank account. This ensures that the value of the stablecoin remains close to the value of the underlying fiat currency. Examples include Tether (USDT) and USD Coin (USDC).

- Crypto-Collateralized Stablecoins: These stablecoins are backed by other cryptocurrencies. The issuing organization holds a reserve of cryptocurrencies and issues stablecoins against that reserve. The value of the reserve should exceed the value of the stablecoins in circulation. Examples include DAI, which is backed by Ethereum and governed by the MakerDAO system and DJED which is backed by ADA the currency of the Cardano blockchain.

- Algorithmic Stablecoins: These stablecoins use algorithms and smart contracts to automatically adjust the supply of the stablecoin to maintain its stability. The goal is to increase or decrease the supply of stablecoins based on market demand and supply, aiming to keep the price stable.

The majority of stablecoins in the market are in USD. The fund may also invest in stablecoins of other currencies. The stablecoins will be lent out on decentralized lending protocols to generate a stable yield. The yield varies between 0% and 20% per year, depending on market conditions. High yield is usually achieved in rising markets when there is in high demand for leverage trading.

Risk Warning

Stablecoins aim to provide stability, they are not entirely risk-free. Factors such as the management of reserves, regulatory challenges, and changes in underlying assets can impact the stability and credibility of stablecoin projects.

Stablecoins, especially those pegged to fiat currencies, might fall under regulatory scrutiny as they are seen as digital representations of traditional money. Changes in regulations or legal actions could impact the operation, issuance, or acceptance of stablecoins.

Fiat stablecoins are issued by private companies or organizations that hold the equivalent amount of assets as collateral. There is a risk that the issuer might mismanage the collateral or become insolvent, which could affect the stability and redeemability of the stablecoin. The issuer is also responsible for maintaining a 1:1 convertability between the stablecoin and the fiat currency - this centralized control introduces a risk of censorship, mismanagement, or changes in governance that could impact the stability of the stablecoin.

Crypto-collateralized stablecoins are collateralized by cryptocurrencies or other assets can be exposed to the price volatility of those underlying assets. If the value of the collateral falls significantly, it might not be sufficient to maintain the stability of the stablecoin.

During periods of stress in the market, some stablecoins might have limited liquidity. This could make it difficult to convert stablecoins into other assets or to redeem them at their pegged value.

Lending stablecoins is done on decentralized platforms such as Aave and Compound. These utilize smart contracts to bring lenders and borrowers together. Additionally, most stablecoins operate on blockchain platforms and use smart contracts. Bugs or vulnerabilities in the code could lead to technical issues, such as loss of funds or the inability to redeem stablecoins and to recover the amount lent through these platforms.

Cash & Carry

Cash & Carry is a trading strategy that involves exploiting price differences between a spot market and a futures market for the same underlying Digital Asset. This strategy aims to capture profits by taking advantage of temporary pricing inefficiencies driven by timing differences of supply and demand.

The Spot market is where Digital Assets are bought and sold for immediate delivery. In this market, the asset's price is determined by the current supply and demand dynamics.

The Futures market involves the trading of contracts that obligate traders to buy or sell an asset at a predetermined price and date in the future. The price of a futures contract reflects expectations about the future price of the asset, which may differ from its current spot price.

This strategy takes advantage of the price discrepancies between the spot and futures markets in the following way:

If the futures price is higher than the spot price, the strategy sells the asset in the Future market at the higher spot price and simultaneously buy the Digital Asset in the spot market at a lower price. This results in a profit equal to the price difference between the two markets.

If the futures price is lower than the spot price, the strategy buys the Digital Asset in the Future market at the lower spot price and simultaneously sell the Digital Asset in the Spot market at a higher price. Again, this generates a risk-free profit based on the price difference.

The profit is realised when the price of the Digital Asset converge in the Spot and the Future market, which can happen before maturity of the Future contract if the there is a large change in the market direction, or at maturity.

The futures market usually trades at a premium to the spot market. The return exists as speculators want to bet on the direction of the market without providing the full capital for the trade (use leverage) and are willing to pay a premium for this. Premiums tend to vary between 0% and 30% per year. The largest premiums are usually available during rising markets.

Risk Warning

Timing is crucial in the Cash & Carry strategies. Digital Asset markets operate 24/7, and price discrepancies can arise and disappear within minutes. There is a risk that the trades may not execute in time due to delays in order placement, network congestion, or technical issues on trading platforms. This can result in only one side of the trade being executed at intended levels, or none at all which can lead to losses.

Unwinding the positions can are subject to the same timing risks therefore there is a risk of slippage and execution of a strategy at a loss.

The strategy often involves trading in the Spot and Futures markets on different exchanges. Managing multiple accounts on different exchanges can be complex and requires efficient monitoring and execution. Mistakes in placing orders or incorrect calculations could lead to losses. Additionally, transactions on multiple exchanges or exposes the Fund to the counterparty risk of each exchange. If an exchange becomes insolvent or faces issues with withdrawals, the funds could be at risk and could lead to losses.

Trading fees, withdrawal fees, and other transaction costs can significantly impact the profitability of arbitrage trades. In some cases, these costs could eat into your potential gains or even turn a profitable strategy into a loss.

Automated Market Making

Automated Market Making are a type of decentralized financial protocol used in blockchain-based platforms to facilitate the exchange of cryptocurrencies and other digital assets. They provide an automated and algorithmic way of determining asset prices and executing trades without relying on traditional order books or intermediaries like centralized exchanges.

AMMs are a byproduct of Blockchain technology. They allow for funds to provide liquidity to other traders and investors in Digital Assets and receive a fee for this service. This is similar to the role of financial institutions when they stand ready to buy and sell securities to their clients. Liquidity providers earn rewards in the form of fees for contributing their Digital Assets to the pool. Fees are collected from traders who perform swaps, and they are distributed proportionally among liquidity providers based on their share of the pool. This strategy has historically generated between 10 to 60% in fees and performs best in volatile and rising markets.

AMMs operate using liquidity pools, which are pools of funds supplied by users who want to participate in trading. These users, known as liquidity providers, deposit pairs of assets into the pool, such as ETH/USDC or BTC/USDT.

The fundamental idea behind AMMs is to maintain a constant equation that balances the values of the assets in the liquidity pool. The equation varies based on the specific AMM algorithm being used. For example, the most well-known AMM, the Constant Product Market Maker (also known as the "x*y=k" equation), is used in protocols like Uniswap.

Instead of relying on order books where buyers and sellers place their bids and asks, AMMs use their constant equations to determine the price of an asset relative to another within the liquidity pool. The more a specific asset is bought, the more its price increases relative to the other asset. When an investor wants to exchange one Digital Asset for another, they interact with the AMM by sending their Digital Asset to the liquidity pool. The AMM automatically calculates the amount of the other Digital Asset they will receive based on the current price determined by the constant equation.

Popular AMM protocols include Uniswap, SushiSwap, PancakeSwap, and Balancer, each with its own unique algorithm and features. AMMs have greatly contributed to the growth of Decentralized Finance (DeFi)by enabling more efficient and decentralized trading, as well as providing opportunities for users to earn passive income through liquidity provision.

The main risk of the strategy is a falling market. In a falling market, the investors will tend to sell to the liquidity provide the asset that is losing in value. Therefore the inventory value that the liquidity provider holds will lose value in USD terms in a falling market. The strategy can lose more than an equivalent investment in the asset without engaging in providing liquidity.

The Board of Directors will continuously monitor the performance of AMM protocols and the Digital Assets available for trading on each and invest in those showing the highest risk/reward potential

Risk Warning

Like all blockchain-based systems, AMMs run on smart contracts. If there are vulnerabilities in the code, malicious actors can exploit these vulnerabilities to steal funds or disrupt the functioning of the protocol. Several instances of smart contract hacks and exploits have affected AMMs in the past.

AMMs are a new technology with fast changing technologies that provide the interface between the smart contracts and and the users operating them. Users interacting with AMMs can potentially make mistakes when executing trades or providing liquidity, leading to the loss of their funds. The irreversible nature of blockchain transactions means that errors cannot be easily undone.

During periods of high network congestion, transactions can be delayed or have higher fees, affecting the usability of the AMM.

While providing liquidity can earn fees, these rewards might not always offset potential losses from impermanent loss or unfavorable market conditions. The AMM strategies work best in volatile markets and where the market is moving sideways. During bull and bear markets they perform worse than buying and holding the underlying asset.

As the DeFi landscape evolves, new AMM protocols are introduced, leading to increased competition. This can affect the liquidity and profitability of strategies that rely on providing liquidity to AMMs. Additionally as more liquidity is provided to AMMs the markets becomes more stable and the amount of fees that these strategies generate reduces.

The regulatory environment for DeFi and AMMs is still evolving. Changes in regulations or legal actions could impact the operation and availability of AMM platforms.

Core Digital Assets

This will be held in Digital Assets the top 10 by Market Value such as Bitcoin, Ethereum, Cardano and Polygon.

Digital assets provide low correlation to traditional financial markets, they can serve as a hedge against market volatility and economic uncertainties. The historical growth of Digital Assets underscores their potential for substantial returns. Early adopters who recognized the disruptive potential of blockchain technology and its application in digital currencies have reaped significant rewards. Moreover, the ongoing evolution of the digital asset landscape promises further innovation and novel investment opportunities, enabling investors to participate in cutting-edge industries and technologies.

Blockchains and Digital Assets grant individuals unprecedented control over their financial holdings. They are built on decentralized networks, eliminating the need for intermediaries like banks and providing direct ownership and control. This financial autonomy aligned with ideals of self-sovereignty and economic empowerment, allows its users to navigate the global economy with greater agency. Additionally, the rise of decentralized finance (DeFi) platforms further demonstrates the transformative potential of digital assets. Through lending, borrowing, yield farming, and more, investors can participate in novel financial services that challenge traditional paradigms and offer new avenues for generating returns.

Allocating a portion of the portfolio to digital assets is a move to hold exposure to innovative technologies, uncorrelated returns, and newfound financial autonomy. While the risks are real and regulatory landscapes are evolving, the potential benefits are equally noteworthy. As the world continues its digital transformation, embracing the opportunities presented by digital assets can position investors at the forefront of a new era in finance and technology.

Those assets that provide staking returns will be staked. Participants who stake their Digital Assets in Proof of Stake blockchains are rewarded for their contribution to network security and consensus. These rewards typically come in the form of additional tokens issued by the network or a portion of transaction fees paid by users.

Staking returns vary between 0 and 7% per year. The main risk in this investment is market direction. These assets lose value in a falling market and gain value in a rising value.

Risk Warning

Digital Assets are based on blockchain technology and smart contracts. Bugs, vulnerabilities, and errors in the underlying code can lead to financial losses or exploitation of assets.

Staking returns offer a way for holders of certain digital assets to earn passive income while contributing to the security and operation of blockchain networks. However, this comes with risks that are specific to each blockchain

Participating in staking requires technical knowledge and the ability to manage and secure your staking infrastructure. Errors in setting up and maintaining validators or staking nodes can lead to missed rewards or other issues. In the worst-case scenario, if a network experiences a critical vulnerability or a malicious attack, your staked tokens could be at risk of being lost or stolen.

Staking also requires ongoing monitoring and management to ensure that the staked assets remain secure and effectively earning rewards.

The regulatory landscape for Digital Assets and staking is still evolving, and changes in regulations could impact the legality of both.

Alternative Investments & Macro Hedges

This will be invested in crypto assets with smaller market capitalizations that are not part of the top 10 and into non-crypto strategies. A small portion of the assets value will be used to buy protection against large-scale fluctuations in the market that can impact a portfolio's overall performance

Investing a small portion of the assets in Alternative Digital Assets can improve the overall performance of the fund, but it also has its risks.

Alternative Digital Assets introduce innovative technologies in the areas such as smart contracts, privacy features, and scalability solutions and they tend to inovate faster than the established Digital Assets in the top 10. Therefore, Investing in these projects can expose you to cutting-edge developments in the blockchain and cryptocurrency space. Thorough research, however, is crucial. Investigate the team behind the Alternative Digital Asset, its technology, use case, adoption rate, and community support are a few of the checks that will be performed before making an investment

Some Alternative Digital Assets in the past have experienced rapid price appreciation, leading to significant returns for early investors (such as Polygon and Fantom). Identify promising projects with strong fundamentals can bring substantial gains.

Markets tend to move in trends and are effected by sentiment, especially the market for Digital Assets. If certain altcoins are gaining attention and traction due to market trends or community excitement, they might present investment opportunities. The Board of Directors will monitor social media channels and investors sentiment to take positions in Digital Assets that are have better odds of appreciating on rapidly changing sentiment and macroeconomic environment.

Risk Warning

Alternative Digital Assets are generally riskier than well-established cryptocurrencies like Bitcoin. Many altcoins fail or become obsolete due to poor execution, lack of adoption, or regulatory challenges. Their prices can be extremely volatile, leading to significant price fluctuations over short periods. This volatility can result in both substantial gains and substantial losses.

Alternative Digital Assets have a great risk of scams and frauds and there is a substantial risk of loosing the whole investment in them.

The Regulatory environments for Alternative Digital Assets is can change quickly, impacting their legality and market viability which can cause a substantial, or total loss of invested funds.

Investor Warning

Despite the above giving an indication as to the allocation of assets and how these will be diversified, the Board of Directors will at all times have absolute and unfettered discretion to modify, amend and recalibrate percentages listed to ensure that the objectives of the fund are met.

Investors must recognise that there are inherent limitations on all trading methods due to the complexity, confidentiality and, in the case of the discretionary features of such approaches, the indefinite nature of such methods. In addition, the description of the trading strategies must be qualified by the fact that trading approaches are continually changing, as are the markets in the underlying investments.

The above is a general description of the asset allocation including details as to the principal types of investments in which the Fund may invest, trading techniques that may be employed, the investment criteria that the Fund plans to apply, and the policy that it has established with respect to the composition of the investment portfolio. The description is merely a summary and investors and/or potential investors should not assume that any descriptions of the specific activities in which the Fund may engage are intended in any way to limit the general descriptions of types of investment activities which the Fund may undertake or the allocation of capital among such investments.

Positions

The Fund expects to have the following number of average Positions across its portfolio but this is subject to change and shall not be construed by any potential investors as an rigid and constant rule, markets may dictate that more/less positions may be required:

- Stable Coins - 10 positions

- Cash & Carry - 10 positions

- Automated Market Making - 20 positions

- Core Crypto Assets - 20 positions

- Alternative Investments & Macro Hedges - 30 positions

The Board of Directors shall meet not less than once per quarter to review and analyse the average positions held by the Fund and will closely monitor these at all times to review the allocation strategy of the Fund, the risk management and ensure that both the strategy and risk align with the investment objectives highlighted herein.

Irrespective of the above the Investment Director and Board of Directors will have sole and absolute discretion to determine average positions and this may be subject to changes throughout the lifecycle of the fund.

Data Privacy Notice

In accordance with Gibraltar and/or European Data Protection Legislation, including but not necessarily limited to the Data Protection Act 2004 (“DPA”) and General Data Protection Regulation (2016/697/EU) (“GDPR”) together (the “Data Protection Legislation”). The Company being the data controller for the purposes of this PPM and the ongoing relationship thereafter with investors, must provide you with information on how the personal data that you provide as part of your application to subscribe for shares will be processed.

Terms used but not defined in this Privacy Notice shall have the meanings ascribed to them in the Data Protection Legislation.

Where your details are provided to the Company as a consequence of your investment in the Company, the Company, acting as data controller may itself (or through a third party such as an appointed Administrator, Secretary or Investment Manager) process your personal information or that of your directors, officers, employees or ultimate beneficial owners. Although the Fund at the initial stage may not be appointing an Administrator, the Board of Directors may at a future date appoint an Administrator and such Administrator may become the data controller. We will notify investors if this occurs.

Purpose of processing and legal basis

The personal data collected from you at the point of investment or provided to the Company on a third parties behalf may be processed by the Company, the Investment Manager/Director or the Administrator (or any of its affiliates, employees, delegates or sub-contractors) for the following reasons:

- To facilitate in the opening of your account with the Company, the management and administration of your shares;

- To ensure that up to date records are kept and maintained;

- In order to carry out anti-money laundering or counter terrorist financing checks or any other similar checks to ensure that the Company meets its legal obligations relating to the prevention of fraud, money laundering, terrorist financing, bribery, corruption, tax evasion and to prevent the provision of financial and other services to persons who may be subject to economic or trade sanctions, on an on‐going basis, in accordance with the Company's procedures and policies and legal commitments.

- to report tax related information to tax authorities in Gibraltar or elsewhere where the need arises.

- Carrying out of statistical analysis and market research

Your consent is not required for any of the foregoing processing reasons above.

Disclosures to third parties and/or data processors

The Company may from time to time disclose your personal information as follows:

- to third parties identified in the PPM and to entities that are companies within the same group of companies to third parties listed in this PPM in order to process the data for the above-mentioned purposes.

- To other third parties such as auditors of the Company or agents of the Administrator (if any) and/or Secretaries whom may process the information for anti-money laundering purposes and investor due diligence checks in order to comply with legal and/or regulatory commitments.

- To competent authorities (including tax), courts, bodies as required by law or requested or to affiliates for internal investigations or reporting.

Transfers outside EEA

The disclosure of personal information to the third parties set out above may involve the transfer of data to India and other jurisdictions outside the European Economic Area ("EEA") in accordance with the requirements of the GDPR. Such countries may not have the same data protection laws as your jurisdiction

Retention Period

The Company and any other third party entitled to process data under this Data Notice will retain your data for as long as required in order to provide services or perform investigations or comply with legal/regulatory requirements.

Your rights

Please note that you have the following rights under the GDPR in relation to your personal information:

- You have a right to be informed of your rights under Data Protection Law and how your personal data is used.

- You have a right of access to and the right to amend and rectify your personal data.

- You have the right to have any incomplete personal data completed.

- You have a right to lodge a complaint with a supervisory authority, in particular in the Member State of your habitual residence, place of work or place of the alleged infringement if you consider that the processing of personal data relating to you carried out by the Company infringes the GDPR.

- You have a right to request that your personal information is erased (in certain specific circumstances).

- You have a right to restrict processing (in certain specific circumstances).

- You have a right to data portability (in certain specific circumstances).

- You also have the right to object to processing where personal data is being processed for marketing purposes and also where the Company is processing personal data for legitimate interests.

Failing to provide information/data

We will not be able to accept an application for subscription from you if you fail to or decline to provide information/data as this is required for us to manage and administer your holding in the Company and so the Company can comply with its legal, regulatory and tax requirements.

Security of your data

The Company takes every effort to ensure your personal data is stored and processed securely in order to ensure that no person or entity has unauthorised access to alter, disclose or destroy the data/information provided.

Investor Requirements

There are no specific investor qualifications under the Financial Services Act in respect of Private Schemes. Investor qualifications may be introduced where a Private Fund is, after a year of trading, converted into an EIF.

Each investor must, upon subscribing, invest a minimum of <<Insert Minimum Investment Amount>> USD, or its equivalent in other currency or Digital Assets. This is a requirement set by the Board of Directors.

The Board of Directors reserves the discretion to consider investments below this threshold on a case-by-case basis. Investors who wish to invest less than <<Insert Minimum Investment Amount>> USD can still be considered if they can demonstrate that they bring other tangible benefits to the fund. These benefits could include strategic partnerships, industry expertise, access to valuable networks, or other resources that can contribute positively to the fund's objectives and performance.

The decision to accept investors below the minimum investment amount will be based on a thorough evaluation of the potential benefits they can bring and their alignment with the fund's goals. The board of directors will assess each situation individually and make a determination on whether to accept such investors. This approach allows the fund to remain flexible and open to opportunities beyond just the monetary investment, recognizing the value of non-financial contributions that certain investors can offer.

Life Cycle of the Fund

The Fund will be formed by virtue of the Company’s incorporation under Gibraltar legislation. This PPM and the Company’s constitutional documents such as the certificate of incorporation, memorandum and articles of association shall when taken together constitute the main documents relating to the Fund.

All seed money for the setup and initial investment into the Fund has been secured.

The Fund will be open-ended and investors, subject to terms set out in this PPM, shall be able to buy and sell shares based on the Funds NAV at any time. There will be no limitation on the frequency of subscriptions.

Restrictions of the Fund

The Fund may use leverage for hedging risks. The fund may also use futures and other derivative instruments to take directional positions in Digital Assets.

The Fund shall not invest in anything that is not listed within the asset allocation/investment strategy.

The Fund will not invest in any of the following assets:

- <<Insert Prohibited asset class 1>>

- <<Insert Prohibited asset class 2>>

Service Providers

Exchanges

<<List the Legal Names and Legal addresses of Exchanges>>

Brokers

<<List the Legal Names and Legal addresses of Brokers>>

Bankers

<<List the Legal Names and Legal addresses of Bankers>>

Administrators

<<List the Legal Names and Legal addresses of Administrators>>

Secretaries

<<List the Legal Names and Legal addresses of Secretaries>>

Legal Advisors

<<List the Legal Names and Legal addresses of Legal Advisors>>

Subscriptions & Redemptions

Redemptions from the Fund will be processed quarterly subject to the requirement that Redemption requests must be received in writing to the Board of Directors no later than 30 days before the end of each relevant quarter.

The notice periods are required in order to avoid mass redemptions within a short space of time.

Assets from one or more of the Core Strategies will be sold proportionally to satisfy Redemption requests.

There will be no Redemption thresholds.

Investors will be able to transfer their shares to either another investor or to another third party which would be classified as one of the identifiable class of members or to another company of which the ultimate beneficial owner is classified as one of the identifiable class of members.

Common Reporting Standard (CRS)

The Common Reporting Standard (CRS) is an international standard for the automatic exchange of financial account information between participating countries. It was developed by the Organisation for Economic Co-operation and Development (OECD) to combat tax evasion and promote global tax transparency. The main purposes are to ensure that all foreign interests held by individuals are reported to their home jurisdiction.

Gibraltar transposed council directive 2014/107/EU of 9 December 2014 amending Directive 2011/16/EU as regards to mandatory automatic exchange of information in the field of taxation and in order to give effect to the aforementioned, Gibraltar adopted the International Co-operation (Improvement of International Tax Compliance) Regulations 2016.

The above recognises CRS and therefore the Fund may be required to identify and report financial accounts/investments held by foreign residents to their local tax authorities

Foreign Account Tax & Compliance Act (FATCA)

The Foreign Account Tax & Compliance Act (“FATCA”) is recognised in Gibraltar. Gibraltar entered a model 1 intergovernmental agreement with the United States regarding FATCA.

Under FATCA, certain U.S. taxpayers holding financial assets outside the United States must report those assets to the IRS generally using Form 8938, Statement of Specified Foreign Financial Assets. The aggregate value of these assets must exceed $50,000 to be reportable, in general, but in some cases, the threshold may be higher.

It can be said that FATCA mirrors CRS in functionality and the purposes of both are fairly similar in that they ensure that foreign interests/assets held by individuals are reported to their home jurisdiction.

The agreement allows for information exchange between Gibraltar’s financial institutions and the IRS. Gibraltar based financial institutions are required to identify and report information on accounts held by U.S taxpayers to the Gibraltar authorities who then in turn will exchange such information with the IRS.

Alternative Investment Fund Managers Directive (AIFMD)

The Alternative Investment Fund Managers Directive (AIFMD) is a regulatory framework established by the European Union (EU) to regulate and supervise alternative investment fund managers (AIFMs) and the alternative investment funds (AIFs) they manage.

Despite Gibraltar not being within the European Union, Gibraltar has transposed AIFMD into domestic legislation.

As part of Gibraltar’s implementation of AIFMD, the GFSC as Gibraltar’s regulatory authority have oversight of compliance with authorisations, ongoing compliance, reporting and other similar measured implemented by the AIFMD.

AIFM’s in Gibraltar must meet the regulatory requirements set out by the GFSC to ensure that they operate at all times within the framework of AIFMD.

Net Asset Value (NAV)

The NAV of the Private Scheme shall be equal to the total assets of the Private Scheme, including but not limited to all crypto assets and FIAT held less total liabilities of the Private Scheme.

The Board of Directors shall calculate the NAV of the Private Scheme on the first day of each quarter, unless it is agreed otherwise. Investors shall receive communications on what the NAV of the Private Scheme is within 5 Business Days of the Boards of Directors calculation.

The valuation of Crypto Assets fundamentally depends on their intricate nature, one of the key considerations to take into account is whether a specific crypto asset grants its owner the right to cash flow in the future or not (i.e. liquidity percentage of the crypto asset). If so, this naturally increases the value.

The above has been taken into account by the Board of Directors and the diversification of the assets have been done in a way which both minimises the risks whilst at the same time ensures that the NAV of the Private Scheme increases over time.

The value of the crypto funds held by the Private Scheme shall be determined by analysing various trading venues (exchanges) to come to a Fair Market Price on each specific Crypto Asset unless it is otherwise determined by the Director(s) that a different method be used, should a different method be used, this will be communicated to Investors 7 Business Days prior to any change.

The Board of Directors shall meet once a quarter, notice of which will be given 7 Business Days in advance to investors, and will access liquidity of the markets and establish a reserve to cover estimated costs on closing down relevant position. The reserve in question will be included in the valuation of the Fund and may include things such as price and/or time slippage, bid/offer spreads, fees and unwinding of hedges.

Possible Effects on NAV

There are currently no accounting standards as to how Private Funds within the crypto space should value its crypto assets as crypto assets are neither financial instruments nor fiat currencies.

At the time of this PPM being drafted, crypto assets are not supported by any central Governmental organisations nor are there any Governmental databases that value crypto assets.

The Board of Directors have adopted the abovementioned valuation methods, which for the purposes of this PPM detail how crypto assets within the Fund will be valued in the absence of internationally recognised accounting principles within this sector.

Investor Warning

Despite the foregoing mentioning that there are no foreseeable changes to Gibraltar legislation regarding funds, investors must at all times acknowledge and understand that there is always the risk of Regulation/Legal Protections being revoked at any time and other risks such as volatility, price fluctuations, market manipulation and security risks can undermine the Fund and have an effect on the NAV of the Fund.

Conflict of Interest

This conflict can arise when fund managers, advisors, or other parties prioritize their own financial gains or personal interests over maximizing returns and minimizing risks for the fund's investors. Such conflicts can undermine the integrity and fairness of investment decisions, potentially leading to adverse outcomes for investors and eroding trust in the fund's management.

Disclosure and proper management of conflicts of interest are essential to ensure that investment funds act in the best interests of their investors.

Prospective investors should be aware that there may be situations in which each and all of the counterparties/service providers could encounter a conflict of interest in connection with the Company and/or the Fund. Should a conflict of interest actually arise, the Board of Directors will endeavour to ensure that it is resolved fairly, providing that any such party who may have such a direct or indirect conflict of interest declares such an interest in resolving such conflict. Irrespective of the aforementioned, nothing in this PPM shall be construed as preventing any of the Board of Directors, the Gibraltar Legal Advisor, the Company Secretary and the Auditor from holding similar positions for other companies or investment funds, with or without similar investment objective and investment strategy that may be in conflict with the Company and/or the Fund.

The Board of Directors and persons connected thereto may hold commercial interests in the success of the Company and/or the Fund. The Board of Directors may be engaged in other substantial activities apart from the activities with respect to the Company and may devote to the Fund only as much time as is reasonably necessary, in their judgement, for its management.

Without limiting the generality of the foregoing, the Director may act as the investment adviser or investment manager for others, may manage funds or capital for others, may have, make and maintain investments in its own name or through other entities, and may serve as officer, director, consultant, partner or stockholder of one or more investment funds, partnerships, securities firms or advisory firms.

The Board of Director and other investors may introduce potential investments to the Fund and be paid a commission/introducers fee by such investments for introducing them to the Fund. The Fund may consider investments in entities or projects in which the Board of Director have an interest or in which they hold shares. If the Fund proceeds to make such investments, such transactions will be on an arm’s length basis. The Board of Director may therefore hold shares or an interest in a company in which the Fund invests.

The Fund may invest in investments where the Board of Director and/or persons associated with the Board of Director, may have an interest and/or may be a shareholder (major or otherwise). Post-acquisition the Board of Director will manage the Investment Asset in the normal way with others Assets.

The Board of Director may, at their sole and absolute discretion, pay fees to promoters and/or introducers from the Management Fees and/or Performance Fees that it receives from the Fund.

The Company Secretary provide company secretarial to other funds and experienced investor funds and will be remunerated in respect of such services. The Administrator and Company Secretary will, however, have regard to their obligations under their respective agreements with the Fund and, in particular, to their obligations to act in the best interests of the Fund so far as practicable, having regard to their obligations to other clients where potential conflicts of interest may arise.

Taxation

Gibraltar is known as a lower tax jurisdiction and has relatively low corporate tax set at 12.5% as of July 2023, the latter tax bracket would apply to the Fund. All income which accrues or derives outside of Gibraltar will not be liable to taxation.

In addition, Gibraltar does not have levy any Value Added Tax, or Capital Gains Tax and there is also no Dividend or Withholding Tax for non-Gibraltar residents.

In most cases, Gibraltar based Funds will not have income accruing or deriving in Gibraltar and in such cases will not be subject to Gibraltar taxation.

Notwithstanding all the above, prospective investors in the Fund should familiarise themselves with and, where appropriate, take advice from their Professional Advisor/s on the laws and regulations (such as those relating to taxation and exchange controls) applicable to the subscription for, and the holding and realisation of, Participating Shares in the places of their citizenship, residence and domicile. The tax consequences for each prospective investor in the Fund of acquiring, holding, redeeming or disposing of Participating Shares will depend upon the relevant laws of any jurisdiction to which the prospective investor in the Fund is subject. Investors and prospective investors in the Fund should seek their own professional advice from their Professional Advisor/s as to this, as well as to any relevant exchange control or other laws and regulations.

There can be no assurance, that in the future the Company and/or the Fund will not be liable to taxation in Gibraltar. Should the income of the Company and/or the Fund be deemed to accrue in or derive from Gibraltar. In particular, there can be no guarantee that the Government of Gibraltar may not in the future be required to change the tax system in Gibraltar to the detriment of companies such as the Fund. No warranty is given or implied regarding the applicability or interpretation of the tax laws in any jurisdiction.

Corporate Governance

Effective corporate governance in an investment fund is crucial in fostering investor trust, mitigating conflicts of interest, and maintaining ethical standards, ultimately contributing to the fund's long-term sustainability and success.

Effective and efficient corporate governance shall play a crucial role in ensuring that there are effective and responsible management systems in place for the Fund.

The main goals and objectives of the Fund are to ensure capital appreciation for its investors, but in order to succeed on this, the Board of Directors shall ensure transparency, accountability and protection of the investors interests, in order to ensure the foregoing, the Fund will adopt the following important principles:

Diverse board composition/experience - Ensuring the Board of Directors have a diverse range of skills, experience and expertise will aid in the success of the Fund.

Fiduciary duty of directors - The Board of Directors will owe a fiduciary duty to act in the best interests of the fund and its investors.

Risk management - Robust risk management frameworks are in place to identify, assess, and mitigate risks associated with the Fund's investments, operations, and regulatory compliance.

Investor protections - The Board of Directors shall prioritise investor protection by providing clear and accurate information about its investment strategies, risks, and performance. Disclosures should be transparent, timely, and easily understandable.

Member Ratification

The Board of Directors must at all times act in the best interests of the Private Fund and although the Board of Directors will bear ultimate responsibility in deciding which investment strategies are to be employed, the Board nonetheless appreciate that it is imperative to ensure that new strategies which are to be adopted align at all times with the Private Fund’s overarching asset allocation criteria. This ensures that all investment decisions made by the Board of Directors are consistent will the Private Funds published objectives and risk management framework herein specified.

In order to achieve true transparency for investors and due to the fact that the Board of Directors recognise the value that each investor brings to the table, the Board will have the authority to request feedback from investors regarding both new and existing investment strategies and these will be taken into account by the Board of Directors.

Furthermore, investors will be kept informed of any material changes in the Private Funds investment strategy shall be communicated to them no less than once each quarter. The Board of Directors will ensure that such reporting continues and that investors are kept abreast at all times of any shifts in strategies.

Monthly Newsletter

A newsletter provides investors with regular updates on the fund's performance, investment strategies, and market insights, which helps in keeping them informed and engaged.

It fosters transparency and trust by offering a consistent channel for communication and showcasing the fund's commitment to open and clear reporting. A monthly newsletter allows the fund to respond quickly to market developments and changes in investment strategy, ensuring that investors are well-informed about any adjustments.

And it serves as a marketing tool, helping attract new investors and demonstrating the fund's expertise in navigating the financial landscape.

The Board of Directors embrace the idea of continuous dialogue and communication with investors. To achieve this, the Board of Directors will produce a quarterly newsletter that serves as a vital communication channel. The newsletter will encompass the following key components:

Performance Review: The newsletter will include a comprehensive overview of the fund's performance for the previous quarter and year. This will encompass data on returns, asset allocation, portfolio performance, and any significant market trends that impacted the fund's performance.

Market Insights: The Board of Directors will provide a forward-looking perspective on the market landscape. This section will highlight potential risks and opportunities anticipated in the upcoming quarter or year. This could encompass analysis of industry trends, macroeconomic indicators, and any pertinent geopolitical factors that might influence the market.

Risk Assessment: The board will outline the identified risks that could impact the fund's performance and provide insight into how these risks are being managed and mitigated. This helps investors to be aware of the potential challenges and the fund's strategies to address them.

Opportunities: Alongside risk assessment, the newsletter will also discuss the potential opportunities the Board of Directors sees in the market. This could involve emerging sectors, technologies, or other investment avenues that align with the fund's strategy.

Administrative Changes: Important updates regarding changes in the fund's administration, management team, or any alterations in the investment strategy will be communicated to the investors through the newsletter. Transparency about such changes helps maintain investor confidence.

Asset Allocation: A detailed breakdown of the changes in asset allocation for the next quarters. This can include information on shifts in percentages allocated to various asset classes as well as New Core Strategies.

Contact Information: The newsletter will provide contact details for investors to reach out with further inquiries or feedback. This ensures that investors can easily get in touch with the Board of Directors for any additional information they might need.

The newsletters will also provide an opportunity for investors to contribute their own ideas and perspectives, enabling a collaborative exchange of information and fostering a sense of engagement and involvement among the investor community.

Fees, Charges & Expenses

Initial Origination Costs

The Company is responsible for paying its initial organisation expenses including expenses relating to the establishment of the Company in Gibraltar, the negotiation and preparation of the contracts to which it is a party, the fees and expenses of its professional advisers and professional fees in connection with the drafting of the Fund’s Private Placement Memorandum and the establishment of the Fund.

The initial organisation costs are anticipated to be in the region of 30,000 USD. Such organisational costs and expenses may be amortised over a period of time not exceeding 60 months commencing from January 2024. The initial organisation costs that have been paid by the Board ofDirector will be reimbursed by the Fund to the Board ofDirector over the amortization period.

Operational Costs

The Board of Directors will control all of the Company’s costs and they will ensure that any costs incurred in respect of services provided to the Company are reasonable and properly incurred. The Board of Director has the option, at its sole and absolute discretion, to pay the fees and expenses of the Company, as it sees fit (including but not limited to the administration fees, company secretarial fees and all other fees incurred by the Company).

The Management and Performance fees collected by the Fund will be used to pay for Operational. Should the cumulative Management and Performance fees fall short of sufficiently covering the aforementioned expenses, the deficit will be addressed by deducting the required amount from the Net Asset Value (NAV) of the fund.

Custody Costs

Due to self-custody, the custody fees at inception will be nil. Notwithstanding this, the Board of Directors will consider migrating to a Multi Computation Platform such a Fireblocks where the minimum custody fee will be $6,000 per annum, this however, will not be used at inception but will remain a consideration based on growth of the Private Fund.

Secretary Fees

The Secretary has been paid by the Investment Director in respect of the incorporation and set up of the Company. The Secretary charges the Fund £3,500 per annum for the provision of the registered office and company secretary and an annual Companies House filing fee. All other company secretarial services will be provided on a time spent basis at in accordance with the Secretary’s standard terms and conditions.

Bank Fees

The Board of Directors will pay commercial rates and charges to its Bank. At the Board of Directors’s discretion, some or all of the Fund’s costs in respect of the Bank’s fees may be paid and absorbed by the BoardDirector from the Management and Performance fees.

Trading Costs

The Fund may, at the discretion of the Directors, bear the expense of trading costs. Trading costs shall include data fees, software licenses, research fees and such other fees incidental to the Fund’s trading operations.

Management fee

The Board of Directors are entitled to be paid a Management fee. The Management fee will be equal to a 2% of the Fund’s net asset value per annum. The Management fee will be payable on a monthly basis and will be paid on the last day of each month.

Performance fee

The Board of Directors are entitled to be paid a Performance fee. The Performance fee will be set as 20% of the Fund's profits. The Performance fee shall be payable on the 30th June of each Financial Year. The Fund Profits shall be construed as any increase in the high watermark of the Fund. The high watermark will be set at the highest level the fund's NAV has reached since the inception or since the last performance fee was paid. Where the Funds NAV increases and surpasses the high watermark, the Board of Directors shall be eligible to receive a performance fee calculated at 20% of the Fund's profits.

The Board of Directors reserves the right to waive in whole or in part the Performance Fee payable. For the sake of clarity Performance Fees will not start to accrue until the investment activity in pursuit of the Fund’s investment objective has commenced.

The Performance Fee is calculated on individual investor basis so that each investor is charged a Performance Fee which equates precisely with their performance and as a percentage of investment profits. This method of calculation is intended to ensure as far as possible that any Performance Fee paid to the Board of Directors is charged only to investors who’s investment has appreciated in value.

The Fund may enter into side letter arrangements with specific Shareholders granting she/he/it/them preferential investment terms by waiving all or some of Management and/or Performance Fees (as applicable). The waiver of some or all of such fees will not affect the value of the investors not having received such preferential investment terms.

The waiving of such Management Fees and/or Performance Fees will result in the NAV being higher than it would be should such Management Fees and/or Performance Fees have been charged.

The Board of Directors may, at their sole and absolute discretion, pay fees to introducers from its Management Fee and/or Performance Fee. For the sake of clarity, these fees will not be payable by the Fund and therefore the Fund will not incur any additional fees, charges nor expenses as a result of the Investment Director paying any such fees.

Equalisation

Equalisation is an accounting methodology for open-ended funds that pay performance fees. It is designed to ensure that (i) the investment manager is paid the correct performance fee; (ii) the investors only pay based on their respective uplift; (iii) the Performance fees are fairly allocated between each investor in the fund.

By using Equalisation, each individual investor who invests in the Fund will, over the course of the Fund’s lifetime, be individually assessed and charged only for their own Performance fee liability. This process helps avoid the possibility that any investor will be unduly advantaged or penalised.

The Fund will use the Series of Shares Equalisation Method with an Equalisation period of 1 month.

Series Accounting requires the Fund to issue a new series of shares each time there is a subscription. At the end of every month, when calculating the NAV per Participating Share, the Performance Fee accruals, if any, are applied to each of the series of share separately corresponding to their respective performance.

Each series will have the same rights attached to them but will have a different issue date and different Net Asset Value. Accordingly, Performance Fees are calculated on a series-by-series basis.

The first Participating Shares issued at Fund launch will be issued as the Lead Series Shares. Each of the subsequent investment into the fund will be issued a new Series and will be consolidated into the Lead Series, at the end of every accounting period. A Performance fee has been paid for each of the Series, including the Lead Series. Each investor effectively sells or exchanges their subsequent Series Shares for Lead Series Shares, and the process repeats in the next accounting period.

Capitalisation

The initial set-up costs will be capitalised and spread over the next five years so as to not affect the profit and loss accounts of the Company and/or NAV of the Fund.

Fundamental Changes

In the event of a fundamental change, as determined by the Board of Directors from time to time which materially impacts the operations, rights or interests of investors, the Board of Directors shall provide prompt notice to all holders of Participating Shares regarding such changes.

For the purposes of this PPM, a Fundamental Change shall include, but shall not be limited to the following:

- any material change to the terms contained within this PPM except those permissible or which the Board have ultimate discretion to change from time to time as specified in this PPM;

- regulatory changes in Gibraltar regarding Private Funds;

- any material security breaches which the Fund is subject to;

- any event such as bankruptcy, insolvency, liquidation or significant financial distress of any major counterparty which the Fund deals with and which as a result may affect the funds ability to fulfil its obligations to investors; and

- any change in ownership of the underlying Company.

In the event of a Fundamental Change, those holding a Participating Share or Shares in the Fund may, at their sole discretion take the following action:

- Continue with their participation;

- Request a redemption subject to redemption notice periods as outlined in this PPM;

- Engage with the Board of Directors in good-faith in order to come to an agreement on amendments or modifications which may be required in order to address or prevent future issues of a similar nature.

Risk Factors

It helps align the fund's strategy with investors' risk tolerance and financial goals, ensuring that their expectations are met while mitigating the potential for significant losses, ultimately promoting the long-term sustainability and success of the investment fund.

An investment in any Fund will involve varied and significant degrees of risk, including, but not limited to, those risks described below, risks are further exacerbated by virtue of the fact that the investments are in part on Cryptocurrency which are known historically to involve a myriad of risks which much be taken into account by all potential investors.

Each investor must be capable of evaluating the risks of the Fund for themselves and understanding the said risks or instructing professional advisors to seek their independent advice on investments. Furthermore, investors should undertake their own due diligence on the Board of Directors and on the company where necessary.

Although there are no qualification requirements under Gibraltar legislation on who may become an investor of a Private Scheme, each prospective investor shall ensure that they have read through this memorandum, fully understood the information contained within this memorandum and if thought necessary by them, instruct legal, tax and financial advisors before committing to the investment.

The non-exhaustive list of risk factors is listed below each taken in turn.

Cryptocurrency Market Volatility

Cryptocurrencies are known for their volatility and can experience significant price fluctuations. The value of the Fund's investments may be adversely affected by market volatility this must be noted by all potential investors.

Digital assets (cryptocurrency) were only introduced fairly recently, the medium to long term of the digital assets is subject to many complex factors which are often difficult to evaluate and ascertain, potential investors should be aware of, and understand the common risks involved in investing within this industry.

Cryptocurrency may still be experiencing a bubble or may experience a bubble again in the future. Extreme volatility in the future, including further declines in the trading prices of bitcoin, could have a material adverse effect on the value of the Interests and the Interests could lose all or substantially all of their value.

Speculators and investors who seek to profit from trading and holding cryptocurrency generate a significant portion of cryptocurrency demand. Such speculation regarding the potential future appreciation in the value of bitcoin may cause the price of bitcoin to increase.

Conversely, a decrease in demand for or speculative interest regarding bitcoin may cause the price to decline. The volatility of the price of bitcoin, particularly arising from speculative activity, may have a negative impact on the performance of the Partnership.

Extreme Market Volatility may lead to decrease of the Private Funds NAV either temporarily or permanently.

Regulatory and Legal Risks

Regulatory actions, legal restrictions, and government policies can impact the cryptocurrency market and affect the value of the Fund's investments. Despite the above, His Majesty’s Government of Gibraltar (HMGoG) has welcomed Cryptocurrency and embraced it as part of the economy of Gibraltar. This has led to Gibraltar being a market leader when it comes to funds and regulation of Cryptocurrency and digital assets. Notwithstanding HMGoG’ stance on Cryptocurrency, no one can foresee any future regulatory action or legal restrictions and despite these not being a foreseeable risk at the time of this PPM being drafted, they are nonetheless inherent risks which must be borne in mind by potential investors.

Legal and regulatory risks pose significant considerations for those investing within the Cryptocurrency space, demanding careful attention and proactive compliance measures. The regulatory landscape surrounding cryptocurrencies is complex and rapidly evolving, with differing approaches across jurisdictions.

Funds must navigate potential challenges related to licensing, registration, and compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations. Changes in regulations or the introduction of new laws can impact the operation and viability of these funds, potentially requiring them to adapt their structures or face legal consequences.

As a Fund we must monitor and comply with securities laws, tax regulations, and any other applicable financial regulations to ensure their activities remain within the boundaries permissible by law.

Cybersecurity and hacking risks

Increases in technology have led to an increase in cybersecurity risks and incidents. Generally, cybersecurity threats can occur from, but are not limited to, gaining unauthorised access to systems and misappropriating assets or sensitive information, corrupting data and/or causing operation disruption.

Private Funds, entrusted with managing digital assets and sensitive financial information, have become enticing targets for sophisticated threat actors seeking to exploit vulnerabilities for illicit gains. One prevalent risk is the threat of hacking and unauthorized access to digital wallets or exchange platforms.

Cybercriminals employ various tactics, including phishing attacks, malware distribution, and social engineering, to deceive unsuspecting victims into divulging login credentials or compromising their security measures. Once inside, hackers can abscond with substantial amounts of funds, wreak havoc on the fund's operations, or manipulate transactions for their benefit. Moreover, the nascent and rapidly evolving nature of the crypto landscape means that cybersecurity practices struggle to keep pace with emerging threats.

Vulnerabilities in smart contracts, decentralized applications, or even underlying blockchain protocols can be exploited, potentially leading to substantial financial losses or reputational damage. Additionally, the interconnectedness of the crypto ecosystem poses systemic risks, where a breach in one entity can have cascading effects on others. To mitigate these risks, the Fund will prioritize robust security measures such as multi-factor authentication, encryption protocols, regular security audits, and employee education on best practices. Implementing stringent access controls, utilizing cold storage solutions, and partnering with reputable cybersecurity firms can provide an additional layer of defence.

Liquidity risks

Given that cryptocurrencies are a relatively new asset with limited trading history, markets for certain cryptocurrencies may be less liquid and more volatile than longer established assets/products.

Liquidity risks loom as a crucial consideration within the realm of crypto funds, demanding meticulous attention and strategic planning. The unique nature of cryptocurrencies, with their decentralized infrastructure and fragmented trading platforms, presents inherent challenges in terms of liquidity.

The liquidity of a crypto fund depends on the availability and depth of markets for buying and selling digital assets. Unlike traditional financial markets, the crypto market can experience bouts of illiquidity and extreme price volatility, leading to potential difficulties in executing trades at desired prices or volumes.

Further to the above, the absence of a central clearinghouse or established regulatory framework [in many other jurisdictions] introduces further uncertainty. Fluctuations in investor sentiment, sudden regulatory changes, or technological disruptions can amplify liquidity risks and make it challenging for crypto funds to meet redemption requests or rebalance their portfolios effectively.

Prudent management of liquidity is extremely important and the Board of Directors will take this into consideration in everything that is done. The Funds must carefully assess the liquidity profile of the underlying assets, maintain appropriate reserves, and implement robust risk management measures.

Operational risks

Operational risks commonly associated with Funds involved in and around Cryptocurrency include technical glitches or system failures within exchanges, trading platforms, or digital wallets can disrupt fund activities, leading to potential financial losses or delays in accessing funds. Human errors, such as mismanagement of private keys or mishandling of sensitive information, can also pose operational risks.

Furthermore, the evolving nature of the cryptocurrency landscape presents challenges in terms of scalability and infrastructure. When transaction volumes increase, networks can experience congestion or slowdowns, affecting the speed and efficiency of the Funds operations. Additionally, the reliance on third-party service providers, such as custodians or technology vendors, introduces risks related to their performance, security protocols, and regulatory compliance.

The Board of Directors will adopt and implement robust operational processes and controls, including redundant systems, backup plans, and regular system audits.

Currency Risk

The Fund may invest in cryptocurrencies denominated in different currencies, exposing it to exchange rate fluctuations and currency risk.

The exchange rate risk is a prominent concern, cryptocurrencies (including stable coins) often trade on various global exchanges and can experience much price disparity between various platforms, although such disparity is not common with stablecoins. Fluctuations in exchange rates between cryptocurrencies and FIAT currencies can often lead to substantial gains, but can also lead to substantial losses, this is part and parcel with the fluctuations associated within the industry.

FIAT currency devaluation or inflation also poses risks to investors when FIAT currencies experience rapid devaluation or high inflation the purchasing power often diminishes, albeit to a certain percentile. Cryptocurrencies can also pose similar risks and the cryptocurrencies value can also experience significant changes in value during economically uncertain times.