Use Cases for Blockchains

Blockchain technology’s core characteristics include decentralization, transparency, immutability, and automation. These elements can be applied to various industries, creating a multitude of use cases. Here are some of the most pertinent blockchain use cases for enterprises, institutions, and governments.

Table of Content

Capital Markets

Issuance of Securities

Issuance refers to the process of offering securities or other investment assets to investors in order to raise capital. Blockchain enables the creation of both digital representations of existing conventional securities and that of wholly new digital assets, brought to market in the form of tokens.

The securitization of financial instruments and securities will become both more customized and streamlined through the use of blockchain issuance platforms. Issuance can be improved across the lifecycle of assets including the digitization of equity at incorporation or for the various assets under management. Conventional security-backed assets can be digitized to create tokens representing individual securities with the improvement of additional programmable functionality.

Blockchain enables new business models such as decentralized crowdfunding which more efficiently raises capital and creates a better distribution of equity and governance rights. Another benefit of blockchain throughout the securitization lifecycle is the increased transparency and ease of cap table management which is conveniently located on a single distributed ledger.

A recent high-profile example was an issuance of a bond on the blockchain by a supranational institution in the European Union - the European Investment Bank

EIB issued a bond on the Ethereum blockchain in 2021

The transaction consisted in the issuance by the EIB of a series of bond tokens on a blockchain, where investors purchase and pay for the security tokens using traditional fiat. The Joint Lead Managers settled the underwriting against the issuer using a representation of central money, the Central Bank Digital Currency (CBDC). The principal is expected to be repaid in commercial fiat at maturity. The transaction uses Ethereum, a public blockchain protocol.

Summary Terms and Conditions for the EIB new bond issue

| Issue Amount | EUR 100m |

| Pricing Date | 27 April 2021 |

| Settlement Date | 28 April 2021 |

| Maturity Date | 28 April 2023 |

| Coupon | 0.000%, annual |

| Re-offer Yield | -0.601% |

| Re-offer Price | 101.213% |

| Governing Law | French law |

| Joint Lead Managers | Goldman Sachs, Santander, Societe Generale |

| Registrar, Fiscal Agent, Settlement Agent and Platform Manager | Societe Generale - FORGE |

| Legal advisers | Linklaters LLP (to EIB) and Allen & Overy LLP (to the joint lead managers) |

| Blockchain | Ethereum public blockchain |

According to the EIB, benefits from such bond digitalization include reducing fixed costs and costs from intermediaries, improved market transparency, and quicker settlement speed. "These digital bonds will play a role in giving the Bank a quicker and more streamlined access to alternative sources of finance to boost finance for projects across the globe," EIB vice president Mourinho Félix said in a statement.

Sales and Trading

Collateral management

According to Wikipedia Collateral has been used for hundreds of years to provide security against the possibility of payment default by the opposing party in a trade. Collateral management began in the 1980s, with Bankers Trust and Salomon Brothers taking collateral against credit exposure.

In the modern banking industry collateral is mostly used in over-the-counter (OTC) trades. However, collateral management has evolved rapidly in the last 15–20 years with the increasing use of new technologies, competitive pressures in the institutional finance industry, and heightened counterparty risk from the wide use of derivatives, securitization of asset pools, and leverage. As a result, collateral management is now a very complex process with interrelated functions involving multiple parties.

Current collateral management processes are slow and inefficient because of manual reconciliations and physical delivery of securities which provide limited ability to respond to market conditions. Information is also incredibly siloed, making it difficult to gain a unified picture of cross-depot, cross-entity collateral holdings. This siloed structure further limits an entity’s ability to optimize across collateral deposits or net balances across entities and geographies.

Blockchain enables more efficient collateral management through the digitization of the collateral holdings into a single, optimized registry. Additionally, smart contracts can enable the precision of collateral management by automatically issuing margin calls and invoking predetermined rules for each bilateral or intermediary relationship. The creation and digitization of collateral tokens or assets facilitate new markets and possibilities. For instance, digitally represented collaterals on the blockchain can be used to redeploy and settle in real-time, eliminating delays between valuation and call.

JPMorgan is also involved in at least two other projects. It’s an investor in a major European-based collateral platform HQLAX, alongside international banks such as Goldman Sachs, Citi, BNP Paribas, BNY Mellon, ING, Commerzbank, UBS and Credit Suisse. The largest outside investor is the Deutsche Boerse which provides a core piece of functionality. In that case, the collateral and securities lending is used for banks to ensure they have the right mix of liquid assets as required by Basel III banking rules.

HQLAx enables market participants to redistribute their collateral by exchanging the ownership of tokenized securities on Corda’s blockchain platform, which no longer requires the underlying securities to move across users.

There are several other DLT-based collateral and securities lending projects, including from the Tel Aviv stock exchange, OCC securities, and the Spanish stock exchange, BME.

Clearing and settlement

Clearing is the process of updating accounts and organizing the transfer of money and securities. Settlement is the actual exchange of assets and financial instruments. Smart contracts can be programmed to match payments to transfers through off-chain cash payments, cryptocurrencies, or stablecoins. For settlement, they can match a variety of models that take into account risk tolerance and liquidity needs of the market that include atomic settlement, deferred settlement, and deferred net settlement.

Wall Street currently uses a third party, the DTCC, to transfer assets, net off balances and collect margin to protect against losses. But Credit Suisse and Nomura dealt directly with each other by recording the trades on a shared digital ledger, and much faster, too.

Settlement of the trade was done through Paxos a specialist blockchain company in settlement. Paxos is the first regulated Trust company using blockchain. By using ledger technology, the company can settle trades instantaneously, automate payment processes and eliminate third-parties. Additionally, the Paxos Standard Token (PAX) is equal to $1 USD, making it stable for digital trades.

The PAX stablecoin has been approved by the New York Department of Financial Services to act as a liquid alternative to cash. The coin can be used for instantaneous settlement in financial transactions, and it offers fully transparent ledger capabilities for accounting purposes.

Decentralized Finance

Decentralized finance—often called DeFi—refers to the shift from traditional, centralized financial systems to peer-to-peer finance enabled by decentralized technologies built on the Ethereum blockchain. From lending and borrowing platforms to stablecoins and tokenized BTC, the DeFi ecosystem has launched an expansive network of integrated protocols and financial instruments.

Whereas our traditional financial system runs on a centralized infrastructure that is managed by central authorities, institutions, and intermediaries, decentralized finance is powered by code that is running on the decentralized infrastructure of the Ethereum blockchain. By deploying immutable smart contracts on Ethereum, DeFi developers can launch financial protocols and platforms that run exactly as programmed and that are available to anyone with an Internet connection.

The breakthrough of DeFi is that crypto-assets can now be put to use in ways not possible with fiat or “real world” assets. Decentralized exchanges, synthetic assets, and flash loans are completely novel applications that can only exist on blockchains. This paradigm shift in financial infrastructure presents a number of advantages with regard to risk, trust, and opportunity.

DeFi is covered in more detail here in a separate article in the workshop of which this article is part.

Central Bank Digital Currencies (CBDC)

A Central Bank Digital Currency (CBDCs) is a digital form of central bank money, which isa legal tender created and backed by a central bank that represents a claim against the central bank and not against a commercial bank or a Payment Service Provider (PSP). CBDC is managed on a digital ledger (which can be a blockchain or not), expediting and increasing the security of payments between banks, institutions, and individuals.

According to a recent study conducted by the Bank for International Settlements, more than 70% of institutions are actively researching and developing proofs of concept for CBDCs.

- CBDCs are digital assets. They are accounted for in a digital ledger that acts as the single source of truth.

- CBDC represents claims against the central bank, just as banknotes do.

- The supply of CBDC is fully controlled and determined by the central bank.

CBDCs Solve Inefficiencies

Blockchain-based CBDC solves for the inefficiencies and vulnerabilities in our current central banking infrastructure by simplifying the creation of a secure payments system that serves as a large-scale, decentralized clearing house and asset register.

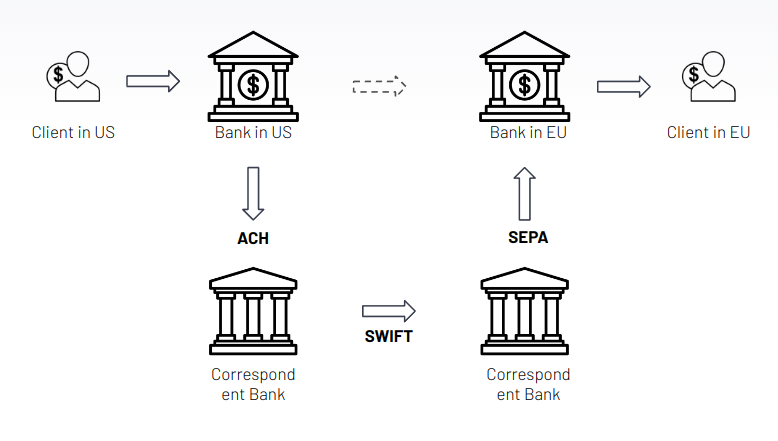

In the current set-up of financial infrastructure sending money from one bank account to another involves multiple steps in the background.

For example:

- A client from Bank in US orders a payment to another Client in Bank in EU

- The bank in US sends a message over ACH (Automated Clearing House) to its Correspondent bank.

- The Correspondent bank in US sends a SWIFT (Society for Worldwide Interbank Financial Telecommunications) message to the Correspondent bank in EU

- Correspondent bank in EU makes a SEPA transfer to Bank in EU

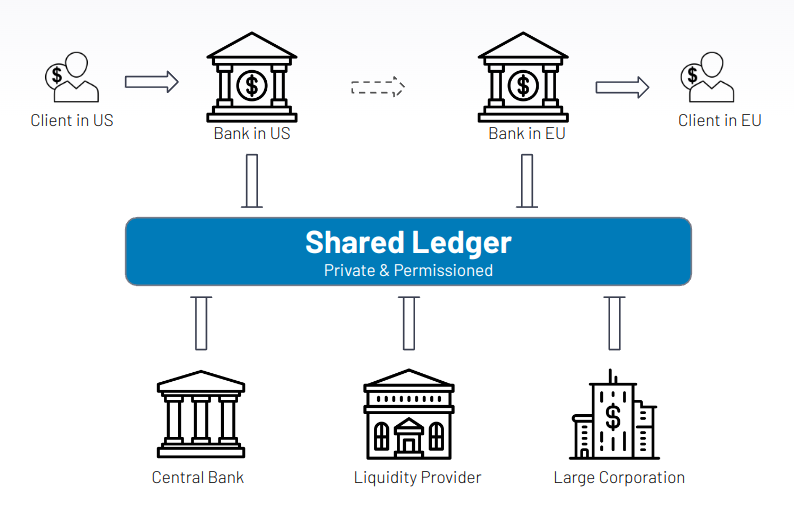

Wholesale CBDC

Wholesale CBDC is used to facilitate interbank settlement - payments between the few banks and other entities that have accounts at the central bank. The daily volume of wholesale CBDC is usually less than 100,000 transactions.

- Through automation and decentralized netting solutions, CBDC payments are settled instantly between counterparties on an individual order basis, reducing the risk of overnight batch processing and collateralization.

- CBDC mitigates credit risk in cross-border payment transactions by enabling payment-versus-payment settlement for transfers in different currencies.

- As more tokenized asset markets emerge, there will be a need for tokenized payments. CBDC provides a large-scale, decentralized clearing house and asset register to help foster the digital assets revolution.

- Even though the cost of real-time money transfers has been reduced by centralized platforms like SEPA in Europe, most financial institutions charge customers above cost. CBDC allows end users to benefit from streamlined banking infrastructure and ensures central banks maintain a role in interbank settlement amidst the wider adoption of stablecoin technology.

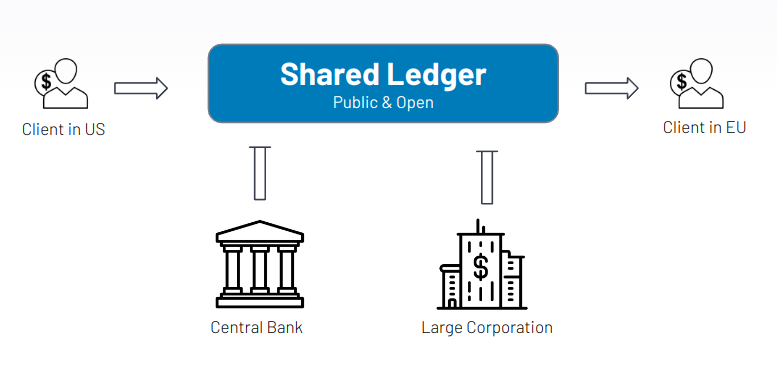

Retail CBDC

Retail CBDC is used for payments between individuals and businesses or other individuals, akin to digital bank notes. The daily volume of retail CBDC is usually greater than 100,000,000 transactions.

- Digital currency can be distributed on mobile devices, increasing access and usability for citizens who are far from bank branches and cannot access physical cash.

- A CBDC is natively digital and does not require the costly and time-consuming reconciliation currently needs for e-commerce and cross-border payments.

- CBDC’s platform-based software model lowers barriers to entry for new firms in the payments sector, fostering competition and innovation and pushing financial institutions toward the globalization of services.

- CBDC gives central banks direct influence over the money supply, simplifying the distribution of government benefits to individuals and improving control over transactions for tax controls.

Decentralized Identity

Decentralized identity services disrupt traditional centralized identity data approaches by enabling people to manage their own identity data and privacy through an intuitive identity wallet that leverages blockchain or other distributed ledger technology (DLT) applications.

The following content is based on a report titled "Innovation Insight for Decentralized Identity and Verifiable Claims" by Gartner. Link to the report at the bottom of the article.

Decentralized identity provides privacy for participants, primarily through consent management and through the use of privacy-preserving protocols such as zero-knowledge proofs (ZKPs) which provide pseudonymity. Pseudonymity means that there is a digital representation of a person/entity, but organizations that have a relationship with the person have no way of correlating it back to a real-world identity.

Governments and service providers, such as banks or employers, in addition to customers, are beginning to experiment with Decentralized Identity as a means to address the limitations inherent in centralized approaches to identity management. The concept of Zero-Knowledge proofs is discussed followed by some example Decentralized Identity use cases.

Zero-Knowledge Proofs

A zero-knowledge proof or zero-knowledge protocol is a method by which one party can prove to another party that a given statement is true while the prover avoids conveying any additional information apart from the fact that the statement is indeed true.

It is important in verifying credentials without revealing what they are. A common example is called "the Ali Baba cave". A link to the Wikipedia page is provided at the end of the article.

In this story, Peggy has uncovered the secret word used to open a magic door in a cave. The cave is shaped like a ring, with the entrance on one side and the magic door blocking the opposite side. Victor wants to know whether Peggy knows the secret word; but Peggy, being a very private person, does not want to reveal her knowledge (the secret word) to Victor or to reveal the fact of her knowledge to the world in general.

They label the left and right paths from the entrance A and B. First, Victor waits outside the cave as Peggy goes in. Peggy takes either path A or B; Victor is not allowed to see which path she takes. Then, Victor enters the cave and shouts the name of the path he wants her to use to return, either A or B, chosen at random. Providing she really does know the magic word, this is easy: she opens the door, if necessary, and returns along the desired path.

However, suppose she did not know the word. Then, she would only be able to return by the named path if Victor were to give the name of the same path by which she had entered. Since Victor would choose A or B at random, she would have a 50% chance of guessing correctly. If they were to repeat this trick many times, say 20 times in a row, her chance of successfully anticipating all of Victor's requests would become vanishingly small (1 in 220, or very roughly 1 in a million).

Thus, if Peggy repeatedly appears at the exit Victor names, he can conclude that it is extremely probable that Peggy does, in fact, know the secret word.

Therefore in this example, Peggy can demonstrate that she knows the secret word without revealing what it is.

A zero-knowledge proof of some statement must satisfy three properties:

- Completeness: if the statement is true, an honest verifier (that is, one following the protocol properly) will be convinced of this fact by an honest prover.

- Soundness: if the statement is false, no cheating prover can convince an honest verifier that it is true, except with some small probability.

- Zero-knowledge: if the statement is true, no verifier learns anything other than the fact that the statement is true.

Educational Credentials

An educational institute could issue credentials and then create an approach to allow for verifiable claims, which represent these educational credentials (e.g., degrees, diplomas, etc.). The people who earned the credentials would be issued the Verifiable Claim and would store the claim in their digital wallet.

When they are challenged for proof that they have a degree, by a credit rating service or potential employer, they can consent, “in real-time,” and issue a “proof” via their identity wallet

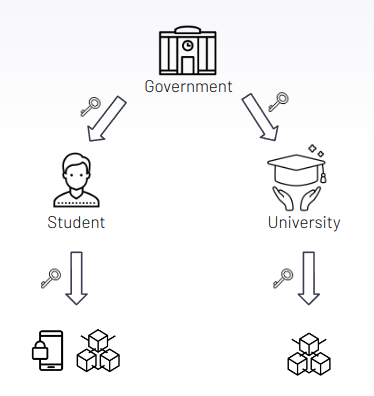

Issuing of DIDs

The government issues a Decentralized Identity (DID) to the Student and to the University. Both are registered on the blockchain. The student might want to keep a copy in his wallet to generate more DIDs

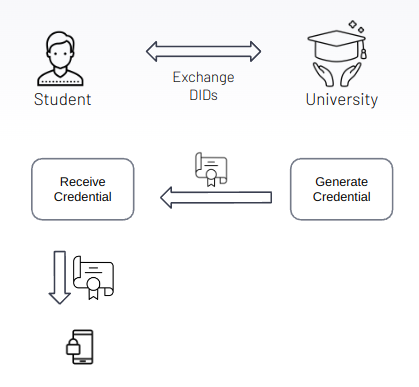

Issuing a Diploma Credential

University issues a Credential with the Diploma and sends it to the Student. The Student stores it in their Digital Wallet

The content of a Credential may be expressed in JSON format and is typically composed of:

- Context

- Issuer

- Issue timestamp

- Expiry timestamp

- Type

- Subject

- Subject identity attributes

- Cryptographic proof to ensure the integrity and authenticity of the Credential

Example of how a Credential might look like

"verifiableCredential":{

"@context":[

"https://www.w3.org/2018/credentials/v1",

"https://www.w3.org/2018/credentials/examples/v1"

],

"id":"0892f680-6aeb-11eb-9bcf-f10d8993fde7",

"type":[

"VerifiableCredential",

"UniversityDegreeCredential"

],

"issuer":{

"id":"did:example:76e12ec712ebc6f1c221ebfeb1f",

"name":"Acme University"

},

"issuanceDate":"2021-05-11T23:09:06.803Z",

"credentialSubject":{

"id":"did:example:ebfeb1f712ebc6f1c276e12ec21",

"degree":{

"type":"BachelorDegree",

"name":"Bachelor of Science"

}

},

"proof":{

"type":"Ed25519Signature2018",

"created":"2021-05-17T15:25:26Z",

"jws":"eyJhbGciOiJFZERTQYjY0Il19..nlcAA",

"proofPurpose":"assertionMethod",

"verificationMethod":"https://pathToIssuerPublicKey"

}

}Citizenship and Government Digital Interactions

Decentralized identity might transform the way nations and citizens (or residents) think about government services. Citizens would be given a Verifiable Claim for their wallet, (the state of Illinois is piloting a similar approach) representing their citizenship, as would legal residents, reflecting their resident status. Requests for the status of citizenship would be provided through Zero-Knowledge Proofs, which would reflect citizenship, but nothing in terms of how that status was attained, ensuring privacy and reducing the potential for discrimination.

In terms of voting, voting rights could be automatically assigned to each eligible voter; and enabled through a verifiable claim for wallet holders. The mechanism for voting would be completely electronic, negating the requirement for polling places, vote counting, etc. Other identifying elements of citizenship, government IDs, records of property ownership, etc., could become a Verifiable Claim.

Finance, Banking and Financial Technology

A large part of financial transactions are validating proof of identity. In the case of a mortgage, many documents are created and signed to verify a significant number of attributes about the buyer, seller and property. With decentralized identity, attributes will be represented as VCs, meaning that the process of closing a mortgage could represent seconds as VCs are exchanged to satisfy banking requirements (banking regulations would have to evolve for this to happen). Closings would no longer require physical presence but would be no more complex than purchasing a hair dryer on Amazon or Alibaba.

Unbanked

There are people around the world, sometimes called “unbanked” or “underbanked,” who have little to no possibility to interact with financial institutions, no opportunities for employment, and very little opportunity for a better life. According to the ID2020 Digital Identity Alliance, there are 1.1 billion individuals worldwide without any means to prove their identity. Once registered, a Decentralized Identity could grant these individuals access to credit and financial opportunity, by leveraging accessible digital identities via a portable digital wallet, which are agnostic to a physical address.

These activities could take the form of verifiable claims. Meaning that conceivably, a person without a permanent address could apply for credit, purchase a car or even create a savings account, allowing them to participate as a full member of society.

Human Resources

Similar to the banking population, there are many face-to-face interactions involved in starting employment with a new company, including validating identity, signing HR forms, etc. With Decentralized Identity, these items would be verifiable claims, easily provided to the employer through a wallet

Hospitality

With the advent of keyless room entry (digital room keys on your phone), Decentralized Identity holds promise to eliminate interactions with the hotel staff altogether, through digital-only and contactless check-ins. The room would be assigned to your wallet, with identity and proof of the ability to pay represented as a Verifiable Claim.

Domain Names

A domain name is a string of text that maps to a numeric IP address, used to access a website from client software. In plain English, a domain name is the text that a user types into a browser window to reach a particular website. For instance, the domain name for Google is ‘google.com’.

The actual address of a website is a complex numerical IP address (e.g. 103.21.244.0), but thanks to DNS, users are able to enter human-friendly domain names and be routed to the websites they are looking for. This process is known as a DNS lookup.

Domain names are all managed by domain registries, which delegate the reservation of domain names to registrars. A registrar is a business that handles the reservation of domain names as well as the assignment of IP addresses for those domain names. Anyone who wants to create a website can register a domain name with a registrar, and there are currently over 300 million registered domain names.

A decentralized DNS service is where the role of the registrar is performed on the blockchain. An example of this is the Ethereum Name Service (ENS) which links .ens domain names to addresses on the Ethereum blockchain. The ENS service makes it possible to register domain names such as mynams.eth and when someone opens it in a web browser it redirects them to a webpage.

Healthcare

Blockchain technology can help healthcare experts and the overall healthcare industry to improve performance, patient data transparency, tracking, and accountability, as well as reduce costs.

Management of Electronic Health Records

Storing and Managing patients' health records on the blockchain enables secure and structured data sharing among the medical community through decentralized databases. These structures work to protect patient data and privacy, allow doctors visibility over their patients’ medical histories, and empower researchers to use shared data to propel scientific progress.

The blockchain can also be used to request and manage patients' consent to records. While patients are unable to change or delete specific medical information input by doctors onto their profiles, they can control access by granting full or partial visibility to various stakeholders in the healthcare ecosystem. For example, patients may share their full records with a medical specialist but may choose to share only non-identifiable data with scientific research firms or other larger healthcare organizations.

Drug Traceability

Drug supply chain management becomes more secure and accountable with the transparency and immutability of the blockchain. Therefore, pharmaceutical companies can register their products on the blockchain and track movement from the source point to end consumer. The next section covers the benefits of using the blockchain for Logistics and Supply Chain in more detail.

Incentivization through Micropayments

Smart contracts enable the introduction of micropayments to incentivize specific patient behavior. These contracts can be programmed to release rewards to patients for following a certain treatment plan or sharing their data for clinical research.

Logistics & Supply Chain

For cryptocurrency networks that are designed to replace fiat currencies, the main function of blockchain is to enable an unlimited number of anonymous parties to transact privately and securely with one another without a central intermediary. For supply chains, it is to allow a limited number of known parties to protect their business operations against malicious actors while supporting better performance.

Blockchain can greatly improve supply chains by enabling faster and more cost-efficient delivery of products, enhancing products’ traceability, improving coordination between partners, and aiding access to financing.

Execution errors—such as mistakes in inventory data, missing shipments, and duplicate payments—are often impossible to detect in real time. Even when a problem is discovered after the fact, it is difficult and expensive to pinpoint its source or fix it by tracing the sequence of activities recorded in available ledger entries and documents. Although ERP systems capture all types of flows, it can be tough to assess which journal entries (accounts receivable, payments, credits for returns, and so on) correspond to which inventory transaction. This is especially true for companies engaged in thousands of transactions each day across a large network of supply chain partners and products.

Making matters worse, supply chain activities are often extremely complicated—far more so than the exhibit depicts. For example, orders, shipments, and payments may not sync up neatly, because an order may be split into several shipments and corresponding invoices, or multiple orders may be combined into a single shipment.

One common approach to improving supply chain execution is to verify transactions through audits. Auditing is necessary for ensuring compliance with contracts, but it’s of limited help in improving decision-making to address operational deficiencies. Consider the problem a food company faces when its products reach the end of their shelf life in a retail store

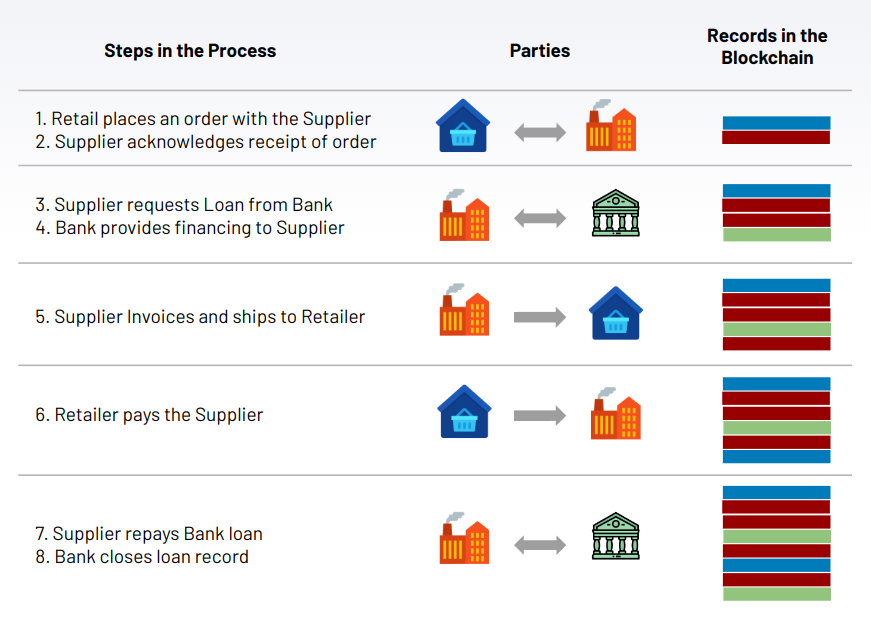

When blockchain record keeping is used, assets such as units of inventory, orders, loans, and bills of lading are given unique identifiers, which serve as digital tokens (similar to bitcoins). Additionally, participants in the blockchain are given unique identifiers, or digital signatures, which they use to sign the blocks they add to the blockchain. Every step of the transaction is then recorded on the blockchain as a transfer of the corresponding token from one participant to another.

Moreover, each block is encrypted and distributed to all participants, who maintain their own copies of the blockchain. Since participants have their own individual copies of the blockchain, each party can review the status of a transaction, identify errors, and hold counterparties responsible for their actions. No participant can overwrite past data because doing so would entail having to rewrite all subsequent blocks on all shared copies of the blockchain.

The bank can also use the blockchain to improve supply chain financing. It can make better lending decisions because by viewing the blockchain, it can verify the transactions between the supplier and the retailer without having to conduct physical audits and financial reviews, which are tedious and error-prone processes

Many of the functions can be automated through smart contracts, in which lines of computer code use data from the blockchain to verify when contractual obligations have been met and payments can be issued.

Sports

Tokenization of Teams

Tokenization of teams allows the public to buy shares in the team represented by tokens, opening ownership to the fanbase while directly raising funds without traditional corporate sponsors. Teams may fundraise to recruit talent, improve stadiums, or achieve other capital-intensive goals. This type of fundraising helps avoid margin loss to brokers and sponsors, while also offering a new level of community, integration, and monetization of the fanbase. Tokenized team shares can be bought and sold freely on an open market, increasing ownership liquidity for sports organizations. Token owners may have the ability to participate in the financial upside of organizations, stadiums, or individual sports teams.

An example of this is the Chilliz blockchain which gives sports fans the chance to connect with their favorite sporting organizations through Fan Tokens, fungible digital assets minted on the Chiliz blockchain. Fan Tokens can be used by fans to access voting rights in polls, VIP rewards, exclusive promotions, AR-enabled features, chat forums, games, and competitions and allow them to compete in global leaderboards

Chilliz has onboarded a number of high-profile European football clubs such as Paris-Saint Germain, FC Barcelona, Inter Milan, Man City, and national football teams such as Argentina and Portugal. Formula One and UFC are also embracing tokenization.

Organizing Events

The blockchain streamlines the organizing and tracking of sports events. It can automate the payout of prizes and create an interactive environment between athletes and fans. An example of this is the Cardano Beam app produced by Dynamic Strategies which allows event organizers to issue NFTs to participants of an event and then drop prizes on the route of the event that the participants can pick up as they are going by. Fans can cheer up the participants by dropping incentives along the route.

Real Estate

Real estate technology has traditionally been primarily concerned with listings and with connecting buyers and sellers. However, blockchain introduces new ways to trade real estate and can enable trading platforms and online marketplaces to support real estate transactions more comprehensively. For example, ATLANT has developed a platform that uses blockchain technology to facilitate real estate and rental property transactions. By tokenizing real property, assets can then be traded much like stocks on an exchange and transactions can be done online

Intermediaries

Brokers, lawyers, and banks have long been part of the real estate ecosystem. However, blockchain may soon usher in a shift in their roles and participation in real estate transactions. New platforms can eventually assume functions such as listings, payments, and legal documentation. Cutting out the intermediaries will result in buyers and sellers getting more out of their money as they save on commissions and fees charged by these intermediaries. This also makes the process much quicker as the back-and-forth between these middlemen gets cut.

Liquidity

Real estate has long been considered an illiquid asset since it takes time for sales to conclude. This isn’t the case with cryptocurrencies and tokens since they can, in theory, be readily traded for fiat currencies through exchanges. However, as tokens, real estate can be readily traded. A seller doesn’t have to wait for a buyer who can afford the whole property in order to get some value out of their property

Fractional Ownership

NFTs can be used to represent ownership of physical items or real estate. An example of this could be fractional ownership. Homeowners could sell part of their property to a large number of small investors by issuing tokens on the blockchain. Investors could hold these tokens and receive a rental income for doing so, profit split on capital appreciation upon sale, or both.

This could also allow people to buy and sell fractional ownership in rental properties, potentially in a liquid market without a middleman. This would open up the world of property investing to many more people and create better options for those that need to unlock equity without borrowing or moving.

In the future, it may be possible to borrow by issuing NFTs backed by ownership of your property. Individual investors could then buy an NFT representing a small part of the debt. Holders of the NFTs would then receive repayments via the blockchain in proportion to how much they lent out.

Transparency

Blockchain commands trust and security as a decentralized technology. Information stored in the blockchain is accessible to all peers on the network, making data transparent and immutable. One only has to go back to the housing bubble crash in 2008 to see how greed and the lack of transparency on the part of institutions can have catastrophic consequences. Since information can be verifiable to peers, buyers and sellers can have more confidence in conducting transactions. Fraud attempts would also be lessened. Smart contracts are increasingly becoming admissible records (for example Vermont and Arizona passed such legislation). As such, smart contracts would have more enforceability beyond the technology itself.

Reduced Costs

The transparency associated with a decentralized network can also trim down costs associated with real estate transactions. Beyond the savings made by cutting out intermediaries’ professional fees and commissions, there are other costs such as inspection costs, registration fees, loan fees, and taxes associated with real estate. These costs even vary depending on the territory that has jurisdiction. Like intermediaries, these can be reduced or even eliminated from the equation as platforms automate these processes and make them part of the system.

Through blockchain technology, it is possible that more people will be able to access the market where transactions can be made more transparent, secure, and equitable. Real estate transactions may eventually become truly peer-to-peer activities with blockchain-powered platforms doing most of the work.

Other

The use cases for blockchain are immense and the ones listed above are just some of the most prominent ones being developed right this moment. Other areas where blockchains have shown potential are:

- Government and Public Sector - voting, digital certificates, value-added tax collection at the point of sale

- Global trade - trade finance, track & trace

- Insurance - claim handling, flight delay insurance insurance

- Law - electronic signature, intellectual property rights, DAOs, arbitration

- Media and Entertainment - self-publishing, disintermediation and micropayments

- Fashion and Luxury - traceability of fabrics and manufacturing; registering ownership of luxury items as NFTs such as NFTs of bespoke jewelry items

References

Blockchain Use Cases by Consensys

Building a Transparent Supply Chain

EIB issues its first ever digital bond on a public blockchain

Blockchain may change equities trading for good

JPMorgan Finds New Use for Blockchain in Trading and Lending

Innovation Insight for Decentralized Identity and Verifiable Claims

Zero-Knowledge Proofs - Wikipedia

What Is a Decentralized Domain Name System?

How Blockchain Technology is Changing Real Estate

Blockchain in commercial real estate: The future is here

How NFTs Could Change Real Estate

Will You Purchase Blockchain Flight Delay Insurance?

License

This work is distributed under a Creative Commons Attribution 4.0 International (CC BY 4.0) The license allows you to copy and redistribute the material in any medium or format, as well as remix, transform, and build upon the material for any purpose, including commercial, as long as you give appropriate credit to the creator.