Legal Structure Basics

With the rise of crypto markets, the interest in investing in the growing DeFi ecosystem has grown as well. The interest comes from retail investors and large corporations, but the means at the disposal of these groups are very different.

Retail investors often lack technical knowledge on investing in crypto assets, managing wallets, and participating in the DeFi protocols. As a result, retail investors usually prefer to give their money to a trusted individual or company to invest on their behalf.

The trusted individual or a company needs to make sure they have the proper legal structure to accept this money and then manage it effectively. Unfortunately, managing funds for friends without documentation is illegal in most jurisdictions.

A fund-like structure incorporated in a blockchain-friendly jurisdiction can solve this.

Table of Content

Background

Individuals and companies need to make sure they have the proper legal structure in place before accepting to manage money for others. Unfortunately, managing funds for friends without documentation is illegal in most jurisdictions.

It is not uncommon to see informal arrangements between friends and family to combine the pot of money and have one particularly capable individual invest it. This, however, is illegal and can lead to bad results if the investments do not go according to plan.

Examples of cases where a legal structure is most likely required:

- A conversation between old friends, where one tells the other about a great opportunity in crypto and how they successfully invested over the past years. The other friend then asks if they can give some of their savings to invest on their behalf.

- You meet someone with an illustrious finance career and tell him about a Decentralized Exchange (DEX) running on a blockchain, where it is possible to provide liquidity. The person gets the idea and wants to give you his money to add liquidity to one of the liquidity pools. Unfortunately, he never dealt with crypto and doesn’t know what a wallet is. He suggests transferring the money to you via a bank account.

- You play football or basketball weekly, and your friends want to pool their money to invest in crypto tokens and provide liquidity into a DeFi protocol.

- A long-term investor in equity and bonds wants to diversify their portfolio and put a little money in crypto. However, the amount is relatively small, so they don’t want to spend time learning how to open accounts on exchanges or create wallets; they want someone to do it for them for a small fee.

Legal Structure General

There are several possible legal structures to formalize the relationship between the investment manager and the investors. They will depend on the jurisdiction, so deciding on a Jurisdiction is key.

Gibraltar

Gibraltar is a blockchain-friendly jurisdiction. Gibraltar’s purpose-built Distributed Ledger Technology (DLT) framework has been in effect since 2018. One of the first pieces of legislation of its kind globally, the framework has been designed to provide an efficient, safe and innovative regulatory framework for firms that use DLT for the transmission or storage of value belonging to others.

The framework positions Gibraltar as a jurisdiction that facilitates innovation, while ensuring it continues to meet its regulatory and strategic objectives and understands the modern need for robust and speedy interaction with regulators in this fast-moving business.

Gibraltar has been the location of choice for crypto funds. It was the 3rd most popular destination for establishing crypto funds, ahead of Luxembourg and Singapore

Taxation

Gibraltar currently enjoys full OECD, IMF and FATF “white list” status. Gibraltar has also entered into arrangements with the US in respect of FATCA and with a separate Intergovernmental Agreement in respect of the automatic exchange of tax information with the United Kingdom. Gibraltar is also fully compliant with the information disclosure obligations contained in the Mutual Assistance Directive applicable to all EU Member States.

Income Tax - Individuals and companies pay income/corporate tax on local earnings (10%), but not on any foreign income. Therefore a company that is resident in Gibraltar, but derives all profits from outside the jurisdiction, will not be liable to pay tax on this income.

Capital Gains Tax - Gibraltar does not have capital gains tax.

Stamp Duty - There is no stamp duty payable on the transfer of shares in a Gibraltar company.

Tax on Dividends - Income tax is not charged on dividends received by a company.

Withholding Tax - There is no withholding tax on dividends, royalties or interest in Gibraltar.

Legal Structure Options

The vehicle of choice and the type of fund needs to be decided. For the vehicle, the simplest choice is a Private limited company, and the simplest fund type, to begin with, is a private fund.

Company

Companies are fully distinct legal entities that enjoy the benefits of limited liability. There are two main types, Public Limited Companies (PLC), whereby shares are available to the public, and Private Companies (Ltd), which are limited by shares or guarantees. There is no restriction on the maximum number of shareholders that Gibraltar registered private or public companies may have.

A director of a Gibraltar company is not required to be a resident of Gibraltar. However, residence substantiates management and control of the Gibraltar company, which is a basis upon which tax residency is determined in Gibraltar and many other jurisdictions.

The company owns the fund and the simplest set-up is a Private Limited Company owning a Private Fund

Private fund

A collective investment scheme ("CIS") that can be offered privately to any identifiable group. It can accept up to 50 participants (investors). There are no restrictions on the type of investor that can subscribe, as long as they belong to an identifiable group. Typically, the participants tend to be families, groups of employees, or groups of individuals or friends wishing to run their investments in a fund structure. Private funds are not regulated or authorized by the FSC. As long as the appointed directors follow the investment objectives stated in the offering document of the private fund, there are no other statutory investment restrictions. This allows private schemes to be established cost-effectively and quickly. A Private Fund is exempt from any licensing requirements and must remain private for a year from the date of the offer.

Experienced Investor fund (EIF)

Is targeted at experienced or high-net-worth investors. Generally, EIFs are formed as a limited company or as a Protected Cell Company ("PCC"). Their benefit over the Private fund is that they can be open-ended and have more than 50 participants. A Private fund can be reclassified as an EIF after one year of operation.

The advantage of a Private Fund over an EIF is that it has a lower regulatory reporting requirement and, as a result, lower operational costs with accounting, auditing, and other record-keeping. It allows for flexibility to start small, with no minimum bet asset value amounts and can scale up after the first year of operations

Documentation

The minimum set of documents that need to be prepared to launch a Private Fund

- Constitutional docs for establishing a private company limited by shares;

- Establishment documents for the private scheme;

- The memorandum sets forth the offer document for the Private Fund, the Prospectus;

- Liaising with the Gibraltar Financial Services Commission (GFSC), to obtain approval for matters such as the name of the company;

- Documents pertinent to the launch of the private scheme.

Parties Involved

The minimum set of service providers and institutions that need to be engaged to set-up a Private Fund in Gibraltar

- A Law firm for drafting regulatory documents

- An Accounting firm for record-keeping

- A management company for coordinating

- The Gibraltar Financial Services Commission (GFSC), the management company will often lease on with GFSC

Costs

Costs can vary depending on the service provider and the complexity of legal docs due to some special conditions that the fund creator might require. The approximate cost to budget for are:

- One-off costs to Create the fund and onboard the first set of investors: ~ $30k

- Annual maintenance costs for Secretariat, Accounting and GFSC disbursements: ~ $10k

Costs to manage the investment portfolio (e.g. Custody, Research and Reporting) are not included in the above estimates and need to be added on top

Fees

Administrators of Private Funds need to charge fees to pay for their expenses with Research, Trading fees, Custody, and Staff.

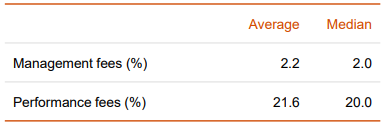

Traditional funds have for a long time adopted the 2/20 fees model, which means they charge a 2% fixed of Assets and 20% performance fee of profits per year. There is usually a waterline at inception, which the assets need to remain above for the administrator to charge performance fees.

The PWC industry survey suggests that crypto funds tend to stick to the same fee structure