DeFi and its Use Cases: Lending, DEXs, Stablecoins ...

Blockchain technology has revolutionized the world of decentralized finance (DeFi). Utilizing blockchain's unique features, DeFi platforms can provide users with a wide range of benefits, including increased security, transparency, and efficiency. In this article, we will explore the benefits of using blockchains for DeFi and some of the primary use cases of this technology.

Table of Content

DeFi

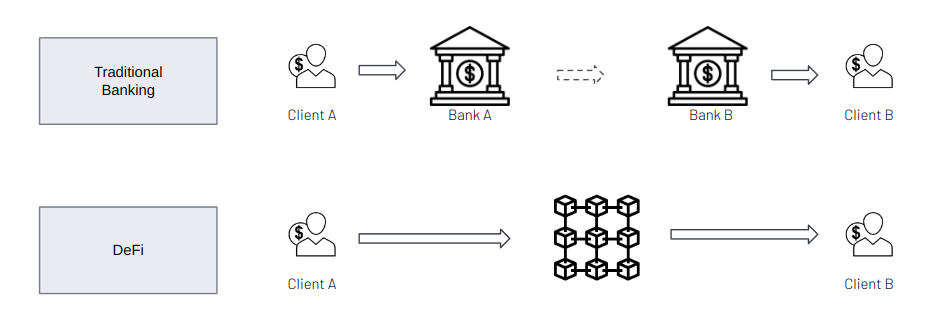

DeFi, or decentralized finance, refers to financial systems without intermediaries such as banks, brokers, or other financial institutions. Instead, DeFi platforms leverage blockchain technology to enable peer-to-peer transactions and execute financial contracts automatically.

DeFi applications allow users to access various financial products and services, such as lending, borrowing, trading, and investing, in a decentralized and permissionless manner. By removing intermediaries, DeFi provides users with more control over their funds and enables them to participate in financial activities that were previously exclusive to institutional investors.

Blockchains offer several benefits for DeFi platforms that traditional financial systems cannot match. Here are some of the primary advantages of using blockchains for DeFi:

Security

Increased security is one of the most significant benefits of using blockchains for DeFi. Blockchain networks utilize cryptographic algorithms to secure transactions and data, making hacking or tampering with the system virtually impossible.

Since blockchain networks are decentralized, there is no single point of failure that hackers can target. This means that even if one node on the network is compromised, the system can continue to operate without disruption.

Furthermore, the use of smart contracts on blockchain networks enables the automated execution of financial agreements without the need for intermediaries. This eliminates the risk of fraud or human error, which is common in traditional financial systems.

Transparency

Blockchains are transparent, meaning that all transactions and data on the network are publicly visible. This provides users with increased transparency and accountability, as they can view and verify all transactions on the network.

This transparency also enables DeFi platforms to operate in a trustless manner, meaning that users do not need to trust intermediaries or other participants in the system. Instead, they can rely on the security and transparency of the blockchain network to execute transactions and agreements.

Efficiency

Blockchains offer significant efficiency improvements over traditional financial systems. Since transactions are executed automatically using smart contracts, there is no need for intermediaries to verify or execute agreements.

This reduces the time and cost associated with traditional financial systems, which often require multiple intermediaries and manual processing. Furthermore, since blockchain networks operate 24/7, transactions can be executed at any time, providing increased flexibility and accessibility for users.

Use Cases

Lending & Borrowing

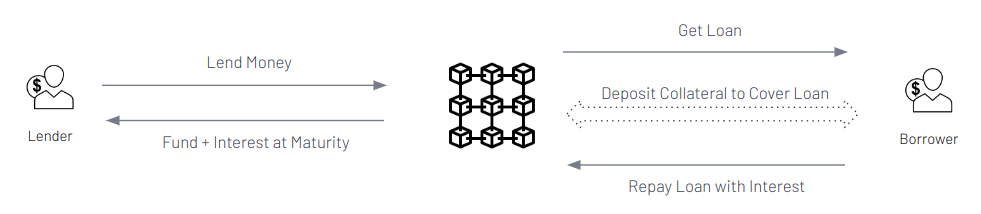

Blockchains are used for lending and borrowing by enabling users to access funds in a decentralized and trustless manner. This is made possible through the use of smart contracts, which are self-executing contracts that automate the lending and borrowing process.

Lending platforms on blockchains work by allowing users to lend their cryptocurrency holdings to others who want to borrow them. The borrowers use their cryptocurrency as collateral and pay interest on the borrowed amount. The lenders receive interest on their funds, typically higher than what they would earn by keeping their cryptocurrency in a traditional savings account.

The process of lending and borrowing on blockchain lending platforms is straightforward. Users can deposit their cryptocurrency into a smart contract and indicate the amount they want to lend and the interest rate they want to receive. Borrowers can then access the funds by depositing their cryptocurrency as collateral into the same smart contract. Once the collateral is verified, the smart contract releases the loan amount to the borrower.

There are several DeFi protocols on different blockchains that facilitate lending and borrowing. Some examples include:

Platforms such as Compound, Aave, MakerDAO, and dYdX are built on Ethereum and Polygon, enabling users to lend and borrow various cryptocurrencies. Platforms such as Venus and Cream Finance enable users to lend and borrow cryptocurrencies on Binance Smart Chain.

Decentralized Exchanges (DEXs)

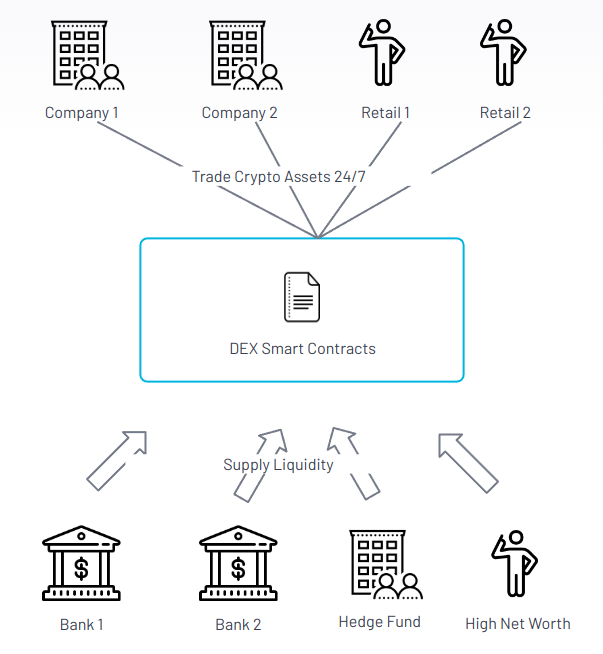

DEXs enable users to trade cryptocurrencies without intermediaries such as centralized exchanges (CEXs).

Blockchains are used for DEXs by enabling the creation of decentralized, transparent, and trustless trading platforms that operate entirely on-chain through smart contracts. These smart contracts are programmed with specific rules that govern how trades are executed, how liquidity is provided, and how fees are collected and distributed.

One of the main benefits of using blockchains for DEXs is that they enable the creation of a transparent and immutable ledger of all trades and transactions. This means that users can verify the integrity of trades and track their funds in real-time without a centralized authority. Additionally, blockchains enable DEXs to operate 24/7 without downtime or maintenance, ensuring users have uninterrupted trading access.

Users can also provide liquidity to these platforms by depositing cryptocurrencies into liquidity pools, which are then used to facilitate trades on the platform. In exchange for providing liquidity, users receive a share of the fees collected by the platform.

Stablecoins

Stablecoins are digital currencies designed to maintain a stable value relative to a specific asset or basket of assets. Blockchains are used for stablecoins by providing a transparent, decentralized, and efficient infrastructure for creating, issuing, and managing these digital assets.

Several types of stablecoins are used in the DeFi space, including:

- Fiat-collateralized stablecoins: These stablecoins are backed by fiat currency held in reserve by a centralized entity. Examples of fiat-collateralized stablecoins include Tether (USDT), USD Coin (USDC), and Binance USD (BUSD).

- Crypto-collateralized stablecoins: These stablecoins are backed by cryptocurrency held in reserve by a smart contract. Examples of crypto-collateralized stablecoins include Dai (DAI), backed by a basket of cryptocurrencies, DJED is an over-collateralized stablecoin by ADA on the Cardano Blockchain.

- Algorithmic stablecoins: These stablecoins are not backed by any underlying asset, but instead rely on algorithmic mechanisms to maintain their stability. The most infamous algorithmic stablecoin was TerraUSD which lost its peg in March 2022 and stopped being a stablecoin.

In each of these types of stablecoins, blockchains are used to facilitate the creation, issuance, and management of these digital assets. Smart contracts are used to automate the process of creating and redeeming stablecoins and manage the collateral held in reserve to back these stablecoins.

Stablecoins are a popular choice for users in the DeFi space, as they provide a stable and secure way to hold and transfer value without the volatility associated with other cryptocurrencies.

Prediction Markets

Prediction markets are platforms that enable users to speculate on the outcome of real-world events, such as elections, sporting events, or market trends. Blockchains are used for prediction markets by providing a transparent and decentralized infrastructure that enables the creation and trading of prediction tokens.

In a prediction market, users can purchase tokens that represent a specific outcome of an event, such as the election of a particular candidate or the outcome of a sporting event. As more users purchase these tokens, the price of the token increases, providing an indication of the perceived probability of that outcome occurring.

Blockchains are used for prediction markets by enabling the creation of these prediction tokens through smart contracts. These smart contracts are programmed with specific rules that govern how the tokens can be created, traded, and redeemed based on the outcome of the event being predicted.

Insurance

Blockchains can be used to create risk pools that enable multiple insurers to share the risk of insuring a particular asset or event. These risk pools can be managed through smart contracts, which automatically distribute payouts to insurers based on their contribution to the pool.

Several blockchain-based insurance platforms have already been developed, including:

- Etherisc: Etherisc is a decentralized insurance platform built on the Ethereum blockchain. It enables users to create and purchase insurance policies, as well as to file and manage claims.

- Nexus Mutual: Nexus Mutual is a decentralized insurance platform built on the Ethereum blockchain. It lets users pool their assets to provide insurance coverage against smart contract failures.

By leveraging blockchain technology, these platforms can significantly reduce fraud, increase transparency, and improve efficiency in the insurance industry.

With Nexus Mutual, for example, members can purchase cover products that protect against different kinds of risk:

- Protocol Cover. For crypto assets deposited in a single protocol deployed on EVM-compatible networks. Protection against a range of loss events caused by exploits, oracle price manipulation, economic design failure, and governance attacks

- ETH Staking Cover. For validator operators who are staking ETH.

Protection against penalties, slashing events, and missed rewards - Custody Cover. For crypto assets deposited on a centralized crypto custodian.

Protection against custodial hacks and custodial withdrawals that are halted for more than 90 days - Yield Token Cover. For crypto assets deposited into a vault strategy that is exposed to multiple protocols. Protection for yield-bearing tokens against any loss event that causes the yield token's market value to depeg from its intended value (i.e., face value)

- Excess Cover. For crypto-native cover providers and other protection providers.

Protection for underlying risk covered by a cover provider

Asset Management

One of the main ways that blockchains are used in asset management is through the creation of digital asset tokens. These tokens can be used to represent a wide range of assets, including real estate, securities, and commodities. By tokenizing assets, it becomes possible to trade them on a blockchain-based platform, which can provide increased liquidity and reduce the need for intermediaries.

Another use case for blockchains in asset management is the creation of smart contracts. Smart contracts are self-executing contracts that are stored on a blockchain and can be programmed to execute when certain conditions are met automatically. These contracts can be used to automate asset management processes, such as the distribution of dividends or the management of voting rights.

For example, a smart contract could be created that automatically distributes dividends to token holders based on the performance of the underlying asset. This would eliminate the need for intermediaries and reduce the time and cost associated with managing assets.

Blockchains can also be used to create decentralized autonomous organizations (DAOs) that enable users to collectively manage assets. DAOs are organizations that are run on a blockchain and are governed by a set of rules encoded in smart contracts. Members of the DAO can vote on decisions related to the management of assets, such as investment decisions or the distribution of profits.

Payment Systems

Blockchains are increasingly being used to improve payment systems by providing a more secure, transparent, and efficient means of transferring value. Traditional payment systems, such as credit cards and wire transfers, can be slow, expensive, and susceptible to fraud. By leveraging blockchain technology, payment systems can be improved in several ways.

Firstly, blockchains can provide a more secure means of transferring value. Traditional payment systems rely on intermediaries, such as banks and credit card companies, to process transactions. These intermediaries can be vulnerable to fraud, hacking, and other security breaches. By using a blockchain-based payment system, transactions are secured by cryptographic algorithms and distributed across a decentralized network, making them much more difficult to hack or manipulate.

Secondly, blockchains can provide greater transparency in payment systems. Traditional payment systems can be opaque, with users having limited visibility into the status of their transactions. With blockchain-based payment systems, however, transactions are recorded on a public ledger that is visible to all participants. This provides greater transparency and accountability, reducing the risk of fraud and error.

Thirdly, blockchains can provide more efficient payment systems by reducing the need for intermediaries and streamlining the transaction process. Traditional payment systems often involve multiple intermediaries, each of which takes a fee for their services. This can make transactions slow and expensive. By using a blockchain-based payment system, transactions can be processed directly between parties, reducing the need for intermediaries and lowering transaction fees.

Governance

Governance is a critical aspect of the financial system as it ensures that decisions are made in the best interests of stakeholders. However, traditional governance structures are often centralized and can be subject to corruption or manipulation. Blockchain technology offers a new paradigm for governance by enabling decentralized decision-making processes.

Decentralized governance on blockchain is often referred to as “on-chain governance” and involves using smart contracts to execute governance rules in a transparent and auditable manner. This is achieved through the use of tokens that represent voting rights, giving token holders a say in the decision-making process. These tokens can be used to vote on key decisions such as protocol upgrades, changes to consensus rules, and even the allocation of funds.

References

License

This work is distributed under a Creative Commons Attribution 4.0 International (CC BY 4.0) The license allows you to copy and redistribute the material in any medium or format, as well as remix, transform, and build upon the material for any purpose, including commercial, as long as you give appropriate credit to the creator.